Benefits Of Hsa And Fsa Accounts Wealth And Investment Services

Benefits Of Hsa And Fsa Accounts Pinnacle Wealth Management You may be able to contribute more to an hsa than an fsa both hsas and fsas have maximum annual amounts you can contribute, which the irs determines each year. employers can also determine fsa limits for their plans. for 2023, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage and $7,750 for family. Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1137908.1.3. an hsa account lets you save pre tax dollars to pay for qualified medical expenses and withdrawals are tax free if you use it for qualified medical expenses. learn more.

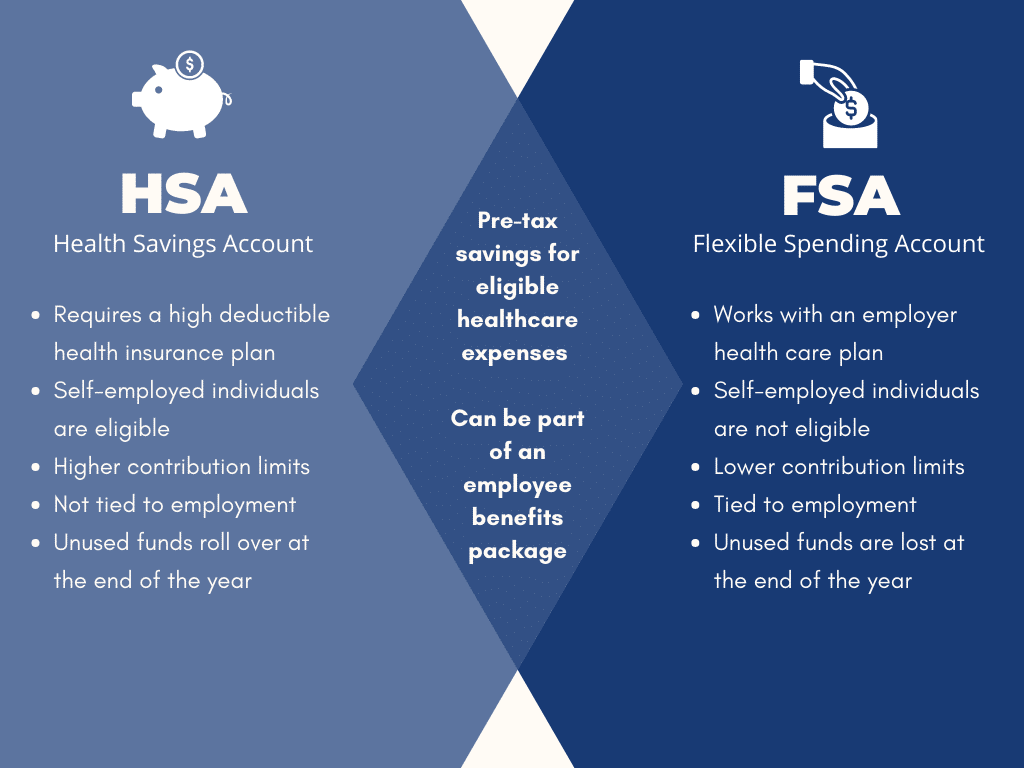

Benefits Of Hsa And Fsa Accounts Lifepath Wealth Advisors But while an hsa and fsa sound similar, there are important differences between them. hsas are tax advantaged accounts either you or an employer can open and contribute to if you have a qualifying. A health savings account (hsa) offers the opportunity to build a stash of cash that can help you pay medical expenses for years or even decades. but not everybody is eligible for an hsa. on the. Getty. health savings accounts (hsas) let you save money to cover the cost of a wide range of qualified medical expenses. hsas offer a trio of tax advantages, and you can invest money saved in an. Umb, which was last covered in 2019, is a merely decent hsa provider. with its $35 maintenance fee that’s waived only when account balances reach $3,000, plus interest rates that start at 0.01%.

The Top 10 Benefits Of Having An Fsa Or Hsa Getty. health savings accounts (hsas) let you save money to cover the cost of a wide range of qualified medical expenses. hsas offer a trio of tax advantages, and you can invest money saved in an. Umb, which was last covered in 2019, is a merely decent hsa provider. with its $35 maintenance fee that’s waived only when account balances reach $3,000, plus interest rates that start at 0.01%. Hsa contributions are deducted from your taxable income, often directly by your employer, which lowers your tax bill. the tax savings equals the amount of your hsa contribution times your marginal. Potential long term benefits of investing your hsa. february 28, 2024 rob williams. health savings accounts (hsas) are for more than just routine medical expenses. by investing a portion of your account, you can potentially grow your funds tax free. health savings accounts (hsas) are particularly prized for their triple tax advantages.

Benefits Of Hsa And Fsa Accounts Wealth Strategy Group Hsa contributions are deducted from your taxable income, often directly by your employer, which lowers your tax bill. the tax savings equals the amount of your hsa contribution times your marginal. Potential long term benefits of investing your hsa. february 28, 2024 rob williams. health savings accounts (hsas) are for more than just routine medical expenses. by investing a portion of your account, you can potentially grow your funds tax free. health savings accounts (hsas) are particularly prized for their triple tax advantages.

Comments are closed.