Benefits Of Cash Value Whole Life Insurance

Whole Life Cash Value Explained Photos All Recommendation The cash value in a whole life insurance policy grows at a fixed rate determined by the policy’s terms. typically, this accumulation begins slowly and picks up pace over time. “the growth of a. Cash value is a component of some types of life insurance. this is a feature that’s typically offered within permanent life insurance policies, such as whole life and universal life insurance.

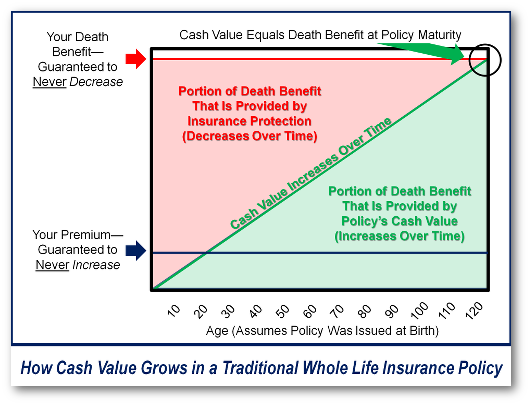

How Whole Life Insurance Works вђ Bank On Yourself The phrase “cash value” refers to a savings component of permanent life insurance, such as universal life and whole life insurance.basically, when you pay your premium, a portion goes toward. Whole life insurance is a lifelong or permanent policy in which you pay a fixed premium for a guaranteed death benefit and guaranteed cash value growth. the insurance company saves a portion of. Cash value life insurance is a form of permanent life coverage that provides living benefits through accrued cash value. these living benefits can be accessed before the death of the insured. commonly interchanged with whole life insurance, the term cash value life insurance serves as a general title for many types of permanent life insurance. The cash value in a whole life insurance policy grows at a fixed rate set by your insurer — typically 1% to 3.5%, according to quotacy, a brokerage firm. this sets whole life insurance apart.

Whole Life Insurance Guaranteed Death Benefit And Premiums Cash value life insurance is a form of permanent life coverage that provides living benefits through accrued cash value. these living benefits can be accessed before the death of the insured. commonly interchanged with whole life insurance, the term cash value life insurance serves as a general title for many types of permanent life insurance. The cash value in a whole life insurance policy grows at a fixed rate set by your insurer — typically 1% to 3.5%, according to quotacy, a brokerage firm. this sets whole life insurance apart. Whole life insurance and taxes. death benefits paid out to your beneficiaries are not considered taxable income. however, because whole life insurance policies have a savings component that accrues interest, there are tax implications to consider. while the cash value of a whole life policy grows tax free, accessing that money can result in a. Cash value life insurance is a type of permanent life insurance that earns money and provides a death benefit to a beneficiary. the cash value investment feature of a permanent policy also earns interest. universal life and whole life insurance are types of life insurance that have cash value.

Cash Value Life Insurance Prioritizing Cash Value Growth Vs Deat Whole life insurance and taxes. death benefits paid out to your beneficiaries are not considered taxable income. however, because whole life insurance policies have a savings component that accrues interest, there are tax implications to consider. while the cash value of a whole life policy grows tax free, accessing that money can result in a. Cash value life insurance is a type of permanent life insurance that earns money and provides a death benefit to a beneficiary. the cash value investment feature of a permanent policy also earns interest. universal life and whole life insurance are types of life insurance that have cash value.

Comments are closed.