Bankruptcy Vs Consumer Proposal

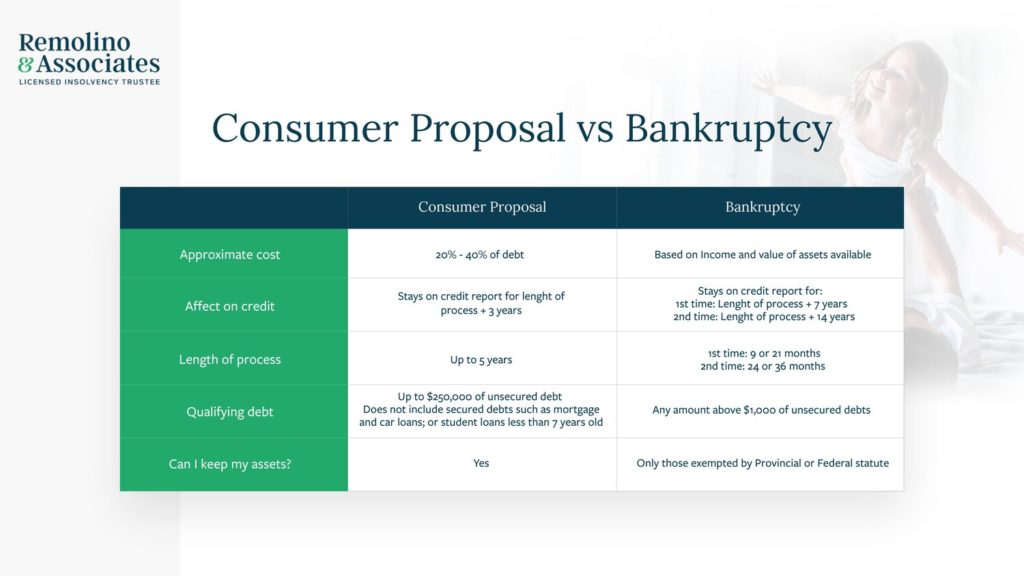

Consumer Proposal Vs Bankruptcy Full Comparison W Chart A consumer proposal is a legal agreement that allows you to pay off debts for less than what’s owed. it’s possible to reduce and pay off up to $250,000 in unsecured debt with a consumer proposal. debt payments can extend up to five years, though not all debts are eligible. secured debts (debts with collateral to back them) and certain. A bankruptcy can be expensive if your income is high, or is expected to increase. in a bankruptcy you lose your tax refund and possibly other assets. a consumer proposal is much simpler than bankruptcy. consumer proposal terms are determined up front. a consumer proposal is proactive. you decide what you can afford to pay.

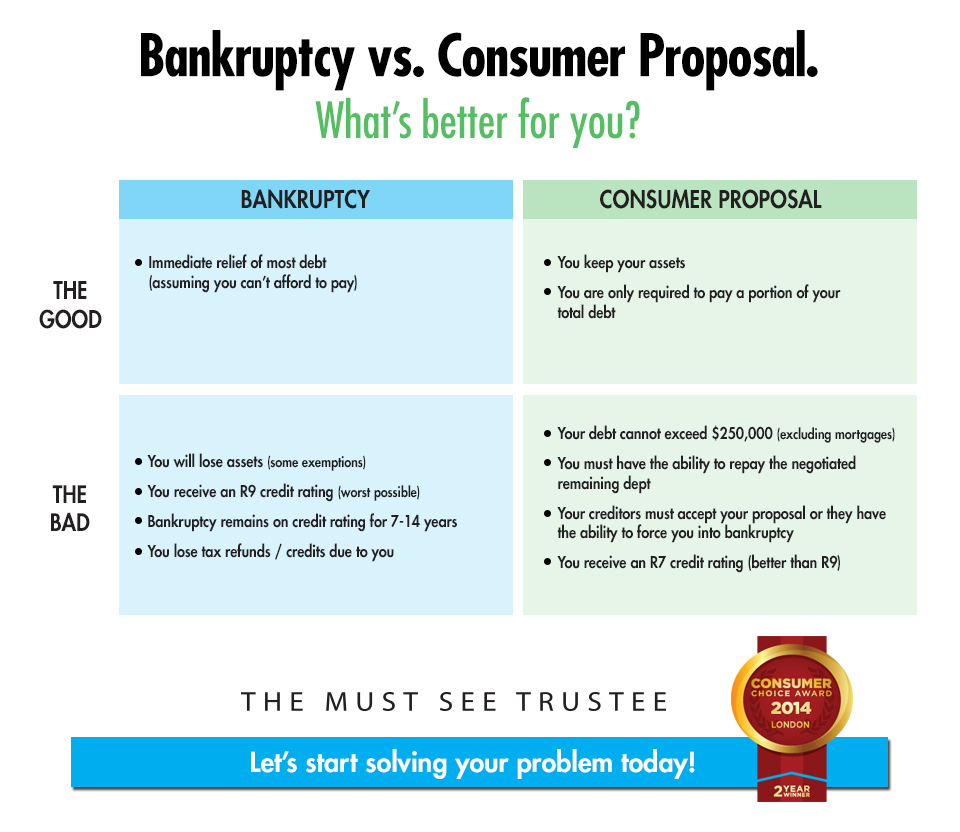

Bankruptcy Vs Consumer Proposal Whats Better For You Paul Pickering Ltd The biggest difference between a consumer proposal and bankruptcy is the impact on your assets. a consumer proposal allows you to renegotiate your unsecured debts (credit cards, lines of credit, etc.) and keep your assets and secured debts, like your mortgage and car loan, separate. if you file for bankruptcy, your unsecured debts are. In this process, the lit will work with you to develop a "proposal"—an offer to pay creditors a percentage of what is owed to them, or extend the time you have to pay off the debts, or both. the term of a consumer proposal cannot exceed five years. payments are made through the lit, and the lit uses that money to pay each of your creditors. Bankruptcy has no debt limits. a consumer proposal can only be filed for non mortgage debt up to $250,000. bankruptcy has no limit to the amount of debt that can be included, only a minimum of $1000. 2. the bankruptcy process takes less time. when you file for bankruptcy, you are usually discharged within nine months. For many debtors, a consumer proposal is a better option than filing for bankruptcy. if you meet the requirements for filing a consumer proposal, which includes having a stable monthly income, it can be better. the costs may be lower than bankruptcy depending on the amount of debt you are carrying. the best way to determine the right option for.

Bankruptcy Vs Consumer Proposal Costs Differences Get Financial Help Bankruptcy has no debt limits. a consumer proposal can only be filed for non mortgage debt up to $250,000. bankruptcy has no limit to the amount of debt that can be included, only a minimum of $1000. 2. the bankruptcy process takes less time. when you file for bankruptcy, you are usually discharged within nine months. For many debtors, a consumer proposal is a better option than filing for bankruptcy. if you meet the requirements for filing a consumer proposal, which includes having a stable monthly income, it can be better. the costs may be lower than bankruptcy depending on the amount of debt you are carrying. the best way to determine the right option for. Once a consumer proposal is filed, there is a legal stay of proceedings that provides you with immediate legal protection from creditors and debt collectors. a consumer proposal may allow you to avoid filing for personal bankruptcy. a successful consumer proposal lets you keep control of your assets, while your unsecured creditors agree to. When to file for consumer proposal vs. bankruptcy. a consumer proposal is better suited for people with debts below $250,000 (or $500,000 for joint proposals with a spouse). this option is preferable if you have a stable income that allows you to make partial debt repayments for up to five years.

Consumer Proposal Vs Bankruptcy O Bryan Law Offices Ky Once a consumer proposal is filed, there is a legal stay of proceedings that provides you with immediate legal protection from creditors and debt collectors. a consumer proposal may allow you to avoid filing for personal bankruptcy. a successful consumer proposal lets you keep control of your assets, while your unsecured creditors agree to. When to file for consumer proposal vs. bankruptcy. a consumer proposal is better suited for people with debts below $250,000 (or $500,000 for joint proposals with a spouse). this option is preferable if you have a stable income that allows you to make partial debt repayments for up to five years.

юааconsumerюаб юааproposalюаб юааvsюаб юааbankruptcyюаб Whatтащs The юааdifferenceюаб

Comments are closed.