Bank Switching Increases As Consumers Seek More Mobile Features

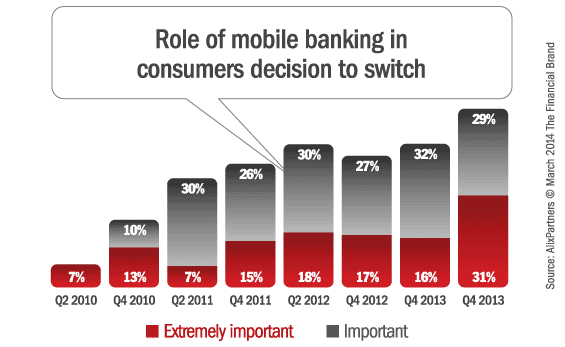

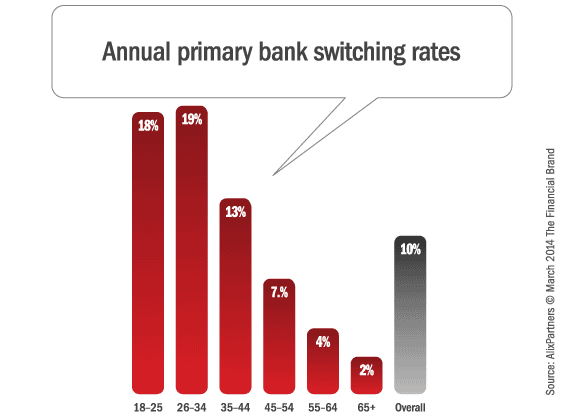

Bank Switching Increases As Consumers Seek More Mobile Features Bank switching increases as consumers seek more mobile features subscribe now get the financial brand's free email newsletter after a period of relative stability, the primary bank switching rate jumped by more than 40 percent in late 2013, with 60 percent of smartphone tablet users reporting mobile banking capabilities as being either. As of 2023, mobile banking is the primary choice of account access for 48 percent of u.s. consumers, making it the most prevalent banking method. (aba) digital wallets, such as paypal and apple.

Bank Switching Increases As Consumers Seek More Mobile Features The use of bank tellers was down to 21%, and telephone banking use was at just 2.4%. mobile banking access rose steadily from 9.5% in 2015 to 34% in 2019. the use of online banking remained. In the third quarter of last year, the cass system reported that more than 15,000 people switched to starling and 6,500 to monzo. although digital challengers have won millions of customers, there. Allowing customers to take control of their banking data, more easily switch banks and secure better service, would save consumers money, time and energy and free us from strong arm tactics. The ascent's survey revealed three key consumer trends in banking: digital banking, fraud protection, and customer service are top banking needs. savings rates are the most important type of.

Bank Switching Increases As Consumers Seek More Mobile Features Allowing customers to take control of their banking data, more easily switch banks and secure better service, would save consumers money, time and energy and free us from strong arm tactics. The ascent's survey revealed three key consumer trends in banking: digital banking, fraud protection, and customer service are top banking needs. savings rates are the most important type of. Not only are consumers expecting more from mobile banking apps; they also consider the quality of a bank’s app more important than the in person banking experience. in a 2020 survey of over 2,000 us consumers by payment card platform marqueta, 21% of respondents said an easy to use mobile app is the most important feature a bank can provide. The human touch remains vital for customer engagement: consumers will be loyal to a bank’s brand if they find it easy to engage online or via mobile – but they still want to talk with a person.

Bank Marketing Strategy Bank Switching Increases As Consumers Look For Not only are consumers expecting more from mobile banking apps; they also consider the quality of a bank’s app more important than the in person banking experience. in a 2020 survey of over 2,000 us consumers by payment card platform marqueta, 21% of respondents said an easy to use mobile app is the most important feature a bank can provide. The human touch remains vital for customer engagement: consumers will be loyal to a bank’s brand if they find it easy to engage online or via mobile – but they still want to talk with a person.

Bank Marketing Strategy Bank Switching Increases As Consumers Look For

Comments are closed.