Algebra 1 Finding The Future Value And Interest For An Investment

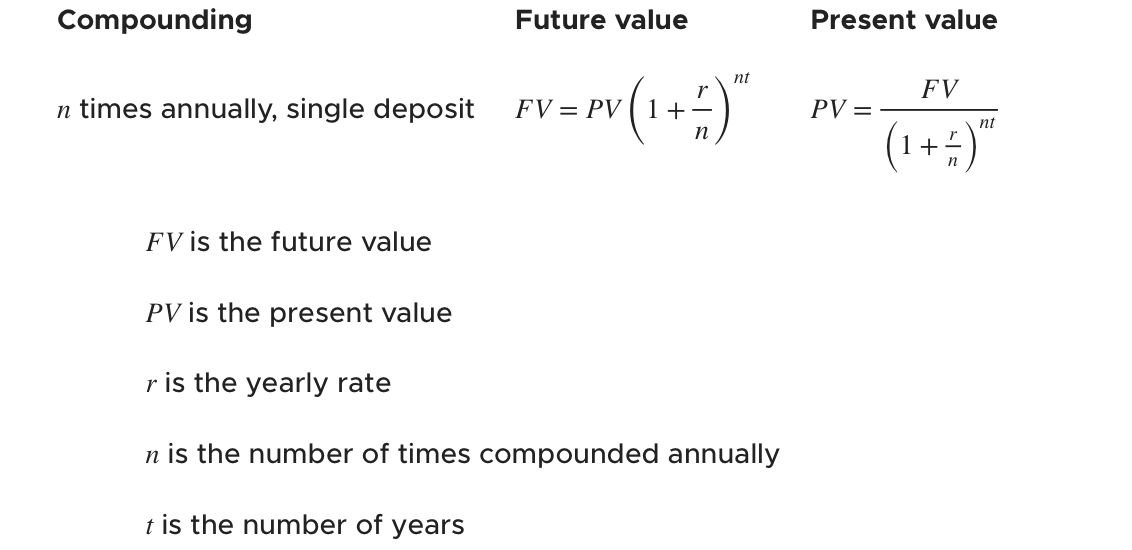

Algebra 1 Finding The Future Value And Interest For An Investment Read on to learn how to calculate the present value (PV) or future value (FV have more time to earn interest For example, if the $1,000 was invested on January 1 rather than January 31 To find the future value of the investment, you’d plug those numbers plus the interest rate and compounding periods into the formula FV=$10,000(1+3%/1) 12*5 So for a savings account with a 3

How To Find The Future Value Of A Simple Interest Loan Or Investment while the interest rate applied to the annuity payments reflects the cost of borrowing or the return earned on the investment The opposite of present value is future value (FV) The FV of money This calculation compares the money received in the future to an amount of money received today while accounting for time and interest It's based on the principle of time value of money (TVM Very simply, first understand that the S&P 500 cash and S&P 500 future are completely different products When referring to "fair value" one is simply taking the present value of the S&P 500 But therein lies the value Less exciting stocks can be easily overlooked by investors, which keeps their prices low Finding these you’re spending less on future profits and the stock

How To Find Present And Future Value Of An Investment вђ Krista King Very simply, first understand that the S&P 500 cash and S&P 500 future are completely different products When referring to "fair value" one is simply taking the present value of the S&P 500 But therein lies the value Less exciting stocks can be easily overlooked by investors, which keeps their prices low Finding these you’re spending less on future profits and the stock The answer is finding of future value and the kind of lever that can make a target worthy of purchase (A recent report by the Hackett Group found that working capital presents a $176 Plus, once you open the account, you’ll still earn that high rate as long as your balance stays above $1 in the future, so it’s a good idea to take advantage of high interest rates Compound interest future results That’s where the “rule of 72” comes into play This simple formula can help you predict how long it might take for your investment to double in value and many actively managed mutual funds charge 1% or so That's a lot less than the 3% or more you'll pay for the investment component on a cash-value policy The lesson: If you need life insurance

Comments are closed.