Aetna Consumer Directed Health Plan

Aetna Consumer Directed Health Care 1 Docx Consumer Directed Issue at a glancejuly 2005market. committed to this innovative health care trend, aetna has developed a full suite of consumer directed health care produc. s that we call aetna health fund®. we have developed our 7th. eneration aetna healthfund product. we also have made access to powerful online information resources and self service tools an. A cdhp is a consumer directed health plan. cdhps use a high deductible, paired with a tax advantages health spending account, or has, to increase the amount of accountability that is in place for personalized health care spending. cdhps include flexible spending arrangements, health reimbursement arrangements, and medical savings accounts.

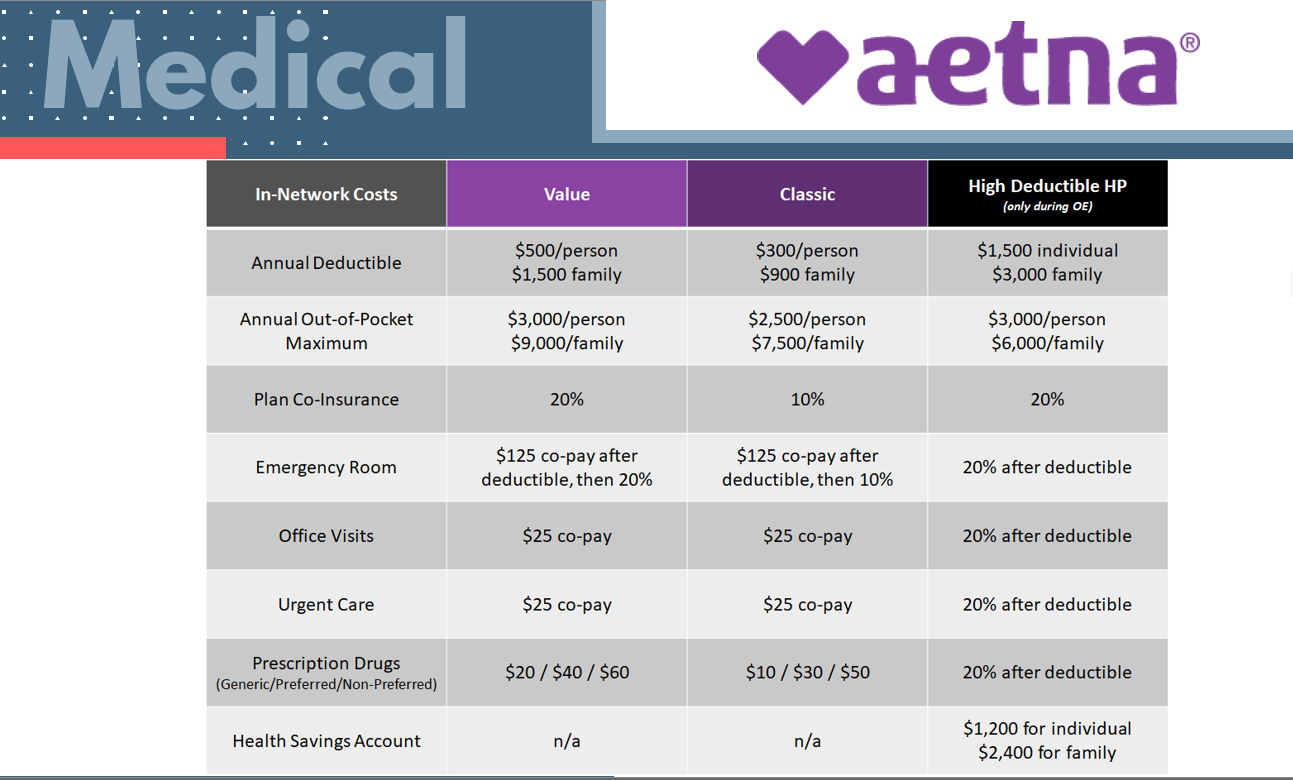

What Is The Aetna Medicare Value Plan Health benefits and health insurance plans contain exclusions and limitations. see all legal notices. aetna offers health insurance, as well as dental, vision and other plans, to meet the needs of individuals and families, employers, health care providers and insurance agents brokers. the path to healthy starts here. Consumer directed health plans have advantages for you, as the plan sponsor: cdhps encourage employees to make informed decisions about their care and spend wisely which can lead to lower costs for you. you get the opportunity to realize lower company expenses through the cost sharing of a high deductible health plan. Consumer driven health plan pros, cons. each type of consumer driven health plan has its benefits. for example, health savings accounts can help members with chronic disease prevention and management. in an online survey of 36 payers, all of them offered a health savings account to their fully insured clients, and 75 percent stated that they. Individual coverage family coverage. tier 1 deductible: $3,500 tier 2 deductible: $7,000 once the deductible is met for that tier, the plan begins to pay for eligible expenses once you meet the family deductible, aetna will pay up to 70% of eligible tier 1 costs while you pay 30%** delhaize provides each family with $300* as well as any funds.

Benefits Consumer driven health plan pros, cons. each type of consumer driven health plan has its benefits. for example, health savings accounts can help members with chronic disease prevention and management. in an online survey of 36 payers, all of them offered a health savings account to their fully insured clients, and 75 percent stated that they. Individual coverage family coverage. tier 1 deductible: $3,500 tier 2 deductible: $7,000 once the deductible is met for that tier, the plan begins to pay for eligible expenses once you meet the family deductible, aetna will pay up to 70% of eligible tier 1 costs while you pay 30%** delhaize provides each family with $300* as well as any funds. Compared to people with ppo plans, aetna healthfund members showed on average: • 7 percent lower total medical costs. • 16 percent savings on pharmacy costs. • 9 percent greater use of routine doctor care. • 9 percent lower use of nonroutine doctor care. you may be able to save close to $247 per member, per year2. Teladoc mental health. ableto. inpathy, aetna's in network telemental health services provider (also known as televideo): call (800) 442 8938. residents outside of new jersey, new york, or pennsylvania should call (800) 535 6689. visits are covered at the same cost as in network mental health visits under the princeton medical plan.

Comments are closed.