Accounts Payable Process 2022 Guide Frevvo Blog

Accounts Payable Process 2022 Guide Frevvo Blog The good news is: you no longer need massive budgets or large i.t. investments to benefit from automation. follow these six accounts payable automation best practices to dramatically increase efficiency, improve compliance, and boost productivity for your ap department. 1. involve your ap team from day one. An accounts payable process flow chart is a visual way of outlining the steps in your accounts payable workflow. it's both a step by step guide and a roadmap, showing you how each step in the process relates to your broader accounting system. you can customize your accounts payable flowchart to suit your unique business or industry, and it'll.

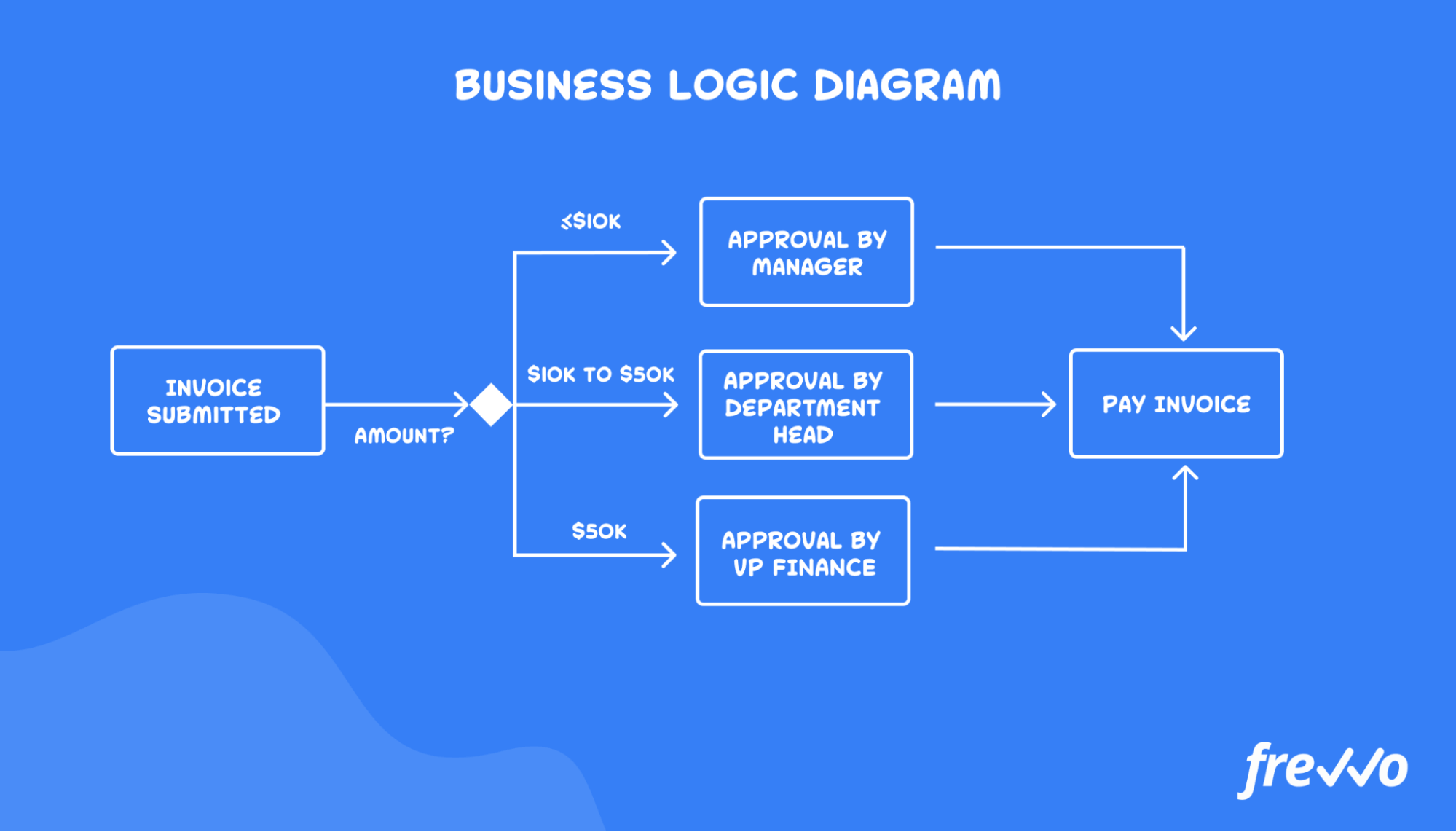

Accounts Payable Process 2022 Guide Frevvo Blog Step 1. create your chart of accounts. the first step of the accounts payable process is to create a chart of accounts, which is an organizational chart that summarizes where you record accounting transactions. generally, a chart of accounts will have five primary account types: income accounts. asset accounts. 15. practice daily reconciliation of accounts. daily ap reconciliation isn't just an accounts payable best practice, it's a good habit. if you need to make an additional payment to a vendor and it’s not recorded, your books won’t match the bank's. this can impact cash flow and lead to errors down the road. The accounts payable process is one of the most important. accounts payable describes the various amounts your business owes to external suppliers for goods and services that you have not yet paid for, for example credit card purchases, production costs, inventory, and repair services. in this post, we’ll dive deeper into the accounts payable. As we advise our customers, invoice approval and payment approval provide distinct layers of oversight that complement and reinforce proper controls. more eyes on your end to end ap flow can catch and correct a variety of errors and opportunities. to sum it up, better safe than sorry! enhanced epayments help you modernize accounts payable in gp.

Accounts Payable Process 2022 Guide Frevvo Blog The accounts payable process is one of the most important. accounts payable describes the various amounts your business owes to external suppliers for goods and services that you have not yet paid for, for example credit card purchases, production costs, inventory, and repair services. in this post, we’ll dive deeper into the accounts payable. As we advise our customers, invoice approval and payment approval provide distinct layers of oversight that complement and reinforce proper controls. more eyes on your end to end ap flow can catch and correct a variety of errors and opportunities. to sum it up, better safe than sorry! enhanced epayments help you modernize accounts payable in gp. Step 1: create a purchase order. creating a purchase order is the first step in the ap process. a purchase order is a document sent to a vendor or supplier to request goods or services. it includes details such as the quantity of items, the price, and the delivery date. The accounts payable process an 8 step essential guide for accounts payable managers purchase order step 2 once your organisation has agreed internally to purchase a particular good or service, it is necessary to advise the supplier of your decision. this is done through the issuance of a purchase order (po).

Comments are closed.