9 Ways To Finance Your Home Improvement Project

9 Ways To Finance Your Next Home Improvement Project North Under the new tax law passed last year, you can deduct interest on up to $750,000 of total home debt used to buy, build, or improve your home. so if you have a $450,000 mortgage and take out a. You can borrow up to $25,000 for a single family home, and repayment terms are typically up to 20 years. title 1 loans above $7,500 require your home as collateral. first time home buyers must be.

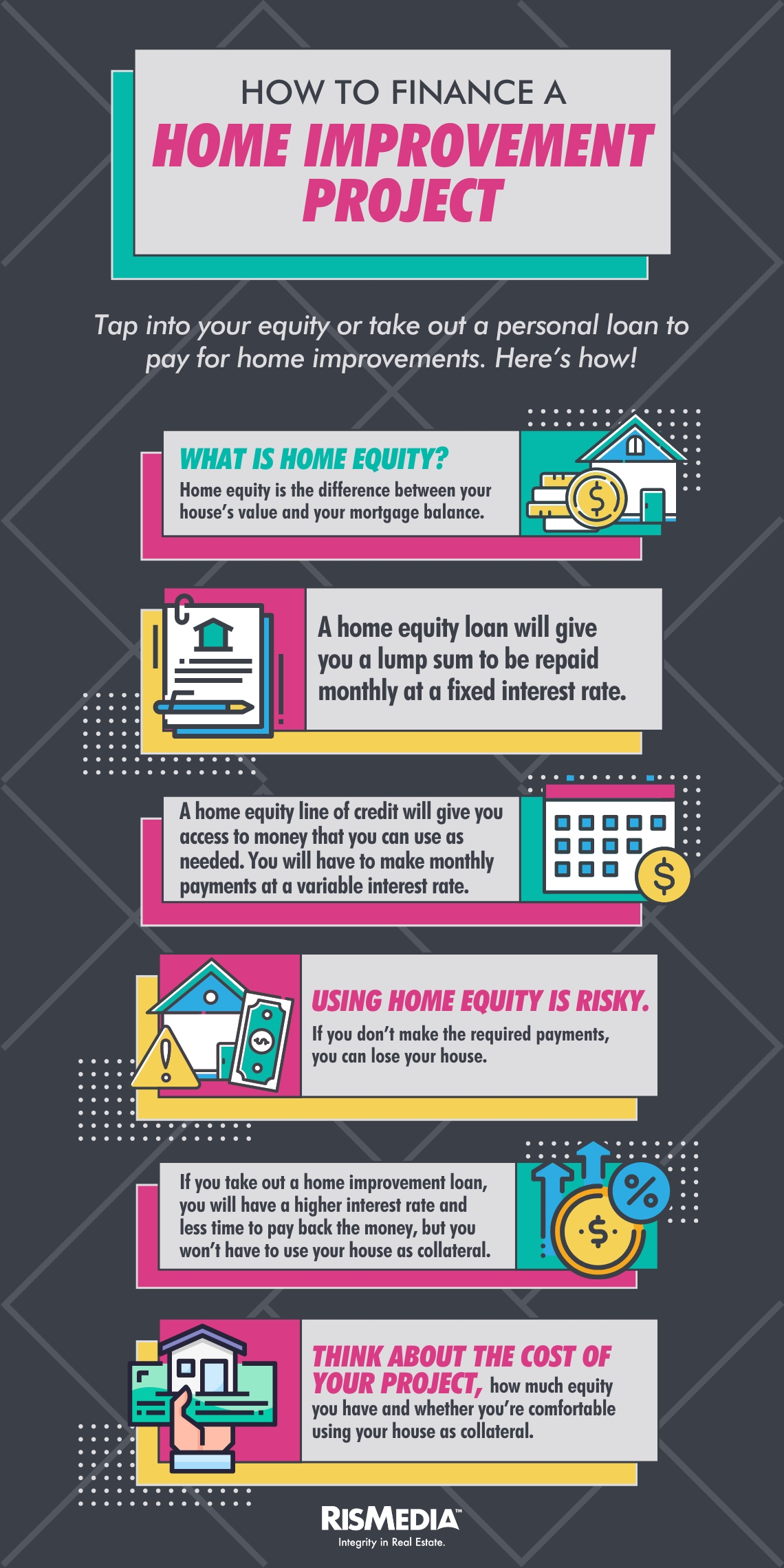

How To Finance A Home Improvement Project вђ Rismedia 7 best ways to finance home improvements. home improvement projects can be expensive and often require financing. luckily, several options are available to help you find the best option for your. Cash out refinance: you’ll pay the lowest interest rate by refinancing your entire mortgage into a larger loan and taking out cash for your renovation. the average rate on a 30 year mortgage has been hovering around 3 percent for the past year. “a cash out refi only makes sense when you’re looking to refi anyway,” says mcbride. 4. save and pay cash. if you want to avoid dealing with loans, fees, interest and more, you could opt to pay for your home improvement in cash. to help you save faster, consider using a high yield savings account. with ally bank’s savings account, you can take advantage of smart savings tools like buckets and boosters. Step 1: save money to pay for home renovations outright. the first option, and for some people the best, is to pay for renovations in cash. doing so may mean it will delay starting the project.

Different Ways To Finance Your Home Improvement Project 4. save and pay cash. if you want to avoid dealing with loans, fees, interest and more, you could opt to pay for your home improvement in cash. to help you save faster, consider using a high yield savings account. with ally bank’s savings account, you can take advantage of smart savings tools like buckets and boosters. Step 1: save money to pay for home renovations outright. the first option, and for some people the best, is to pay for renovations in cash. doing so may mean it will delay starting the project. Financing your remodel allows you to preserve your cash reserves for other purposes or emergencies. it can also make larger projects more attainable by spreading out the cost over time. additionally, interest on home improvement loans may be tax deductible, offering further financial benefits. In addition, the repayment periods are shorter—usually between three and seven years. 3. credit cards. depending on the amount of your project, you may want to put it on your credit card. jody.

Financing Your Home Improvement Project A Full Guide Adore Them Financing your remodel allows you to preserve your cash reserves for other purposes or emergencies. it can also make larger projects more attainable by spreading out the cost over time. additionally, interest on home improvement loans may be tax deductible, offering further financial benefits. In addition, the repayment periods are shorter—usually between three and seven years. 3. credit cards. depending on the amount of your project, you may want to put it on your credit card. jody.

9 Ways To Finance Your Home Improvement Project

Comments are closed.