50 30 20 Budget Rule For 20 Hour Budgeting

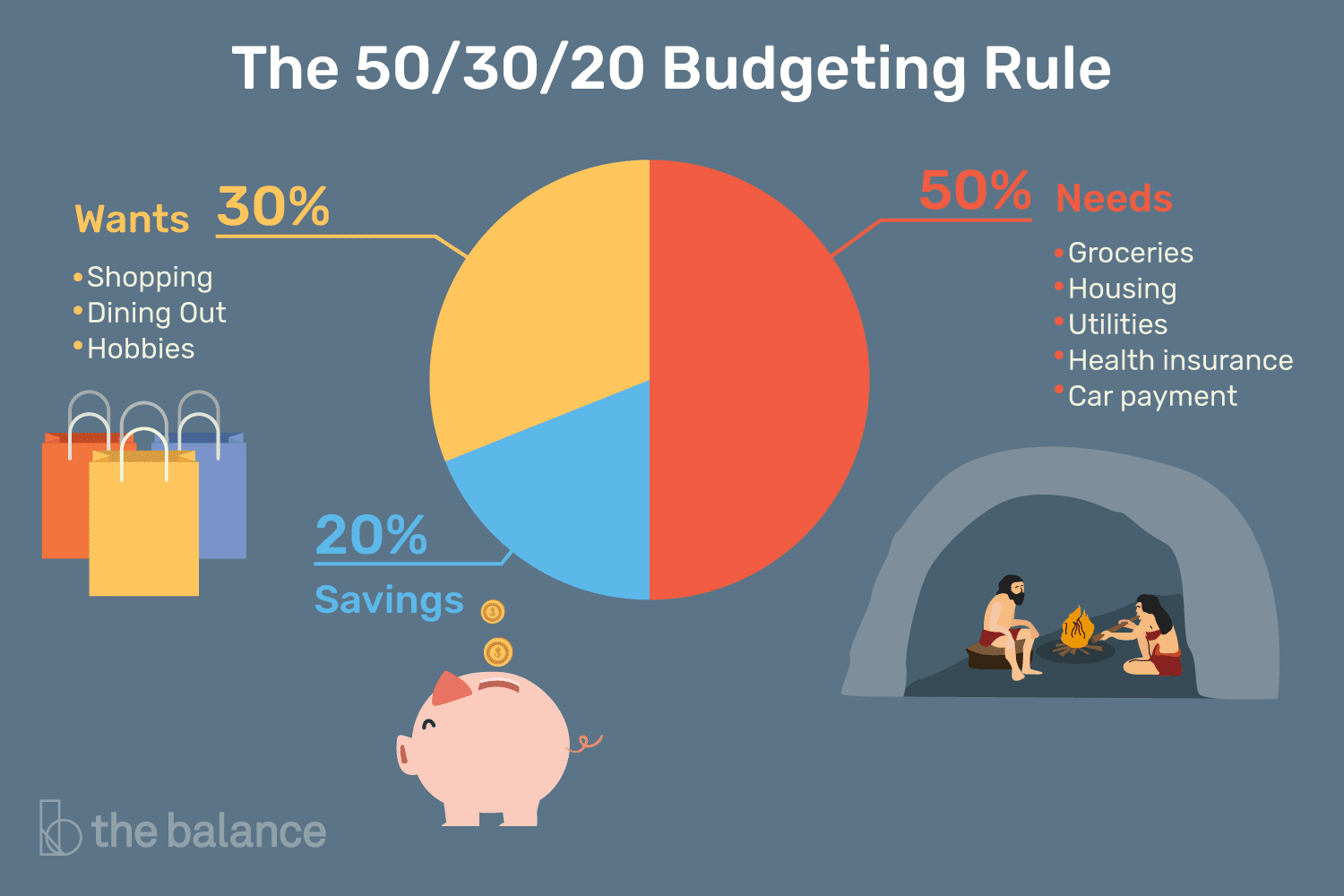

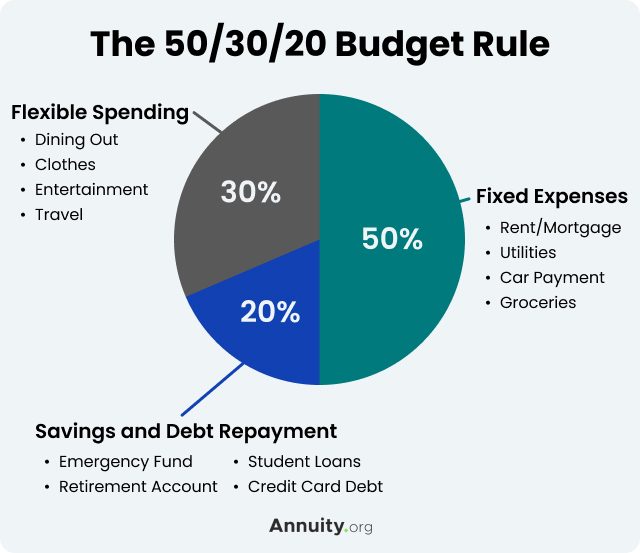

The 50 30 20 Rule вђ A Quick Start Guide To Budgeting How the 50 30 20 budget calculator works. our 50 30 20 calculator divides your take home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for. Key takeaways. the 50 30 20 budget rule states that you should spend up to 50% of your after tax income on needs and obligations that you must have or must do. the remaining half should dedicate.

50 30 20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Ski What is the 50 30 20 budget? the 50 30 20 system was designed to make budgeting more accessible to people who get overwhelmed by complicated spreadsheets and budgeting apps. it was popularized by senator elizabeth warren in her book all your worth: the ultimate lifetime money plan. the beauty of the 50 30 20 budget is in its simplicity. The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income (i.e., your take home pay): 50% to needs, 30% to wants and. Now that you know what the 50 30 20 rule is, we can discuss an example. suppose your monthly after tax income is $4500. according to the rule, you should allocate your salary as follows: 50% of $4500 to your necessities, which is. (4500 × 50) 100 = $2250; 30% of $4500 to your wants, which is. (4500 × 30) 100 = $1350; and. First, income. $74,580 is the median household annual income. 1. $5,017 is roughly a household’s monthly take home pay (after taxes, social security and medicare come out). 2. breaking that down with the 50 30 20 rule, you’d have $2,509 to spend on needs. next, expenses.

50 30 20 Budgeting Rule What Is It And How To Use It Now that you know what the 50 30 20 rule is, we can discuss an example. suppose your monthly after tax income is $4500. according to the rule, you should allocate your salary as follows: 50% of $4500 to your necessities, which is. (4500 × 50) 100 = $2250; 30% of $4500 to your wants, which is. (4500 × 30) 100 = $1350; and. First, income. $74,580 is the median household annual income. 1. $5,017 is roughly a household’s monthly take home pay (after taxes, social security and medicare come out). 2. breaking that down with the 50 30 20 rule, you’d have $2,509 to spend on needs. next, expenses. In its simplest form, the 50 30 20 budget rule divides your after tax income into three distinct buckets, which are: 50% to needs. 30% to wants. 20% to savings. a plan like this helps simplify finances and is also easy to follow. The 50 30 20 budget rule is a simple and effective method for managing personal finances. this rule allocates after tax income into three main categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. budgeting is crucial for achieving financial stability and success. it helps individuals track their spending, identify.

Comments are closed.