5 Tips To Improve Credit Scores вђў Utah Valley Moms

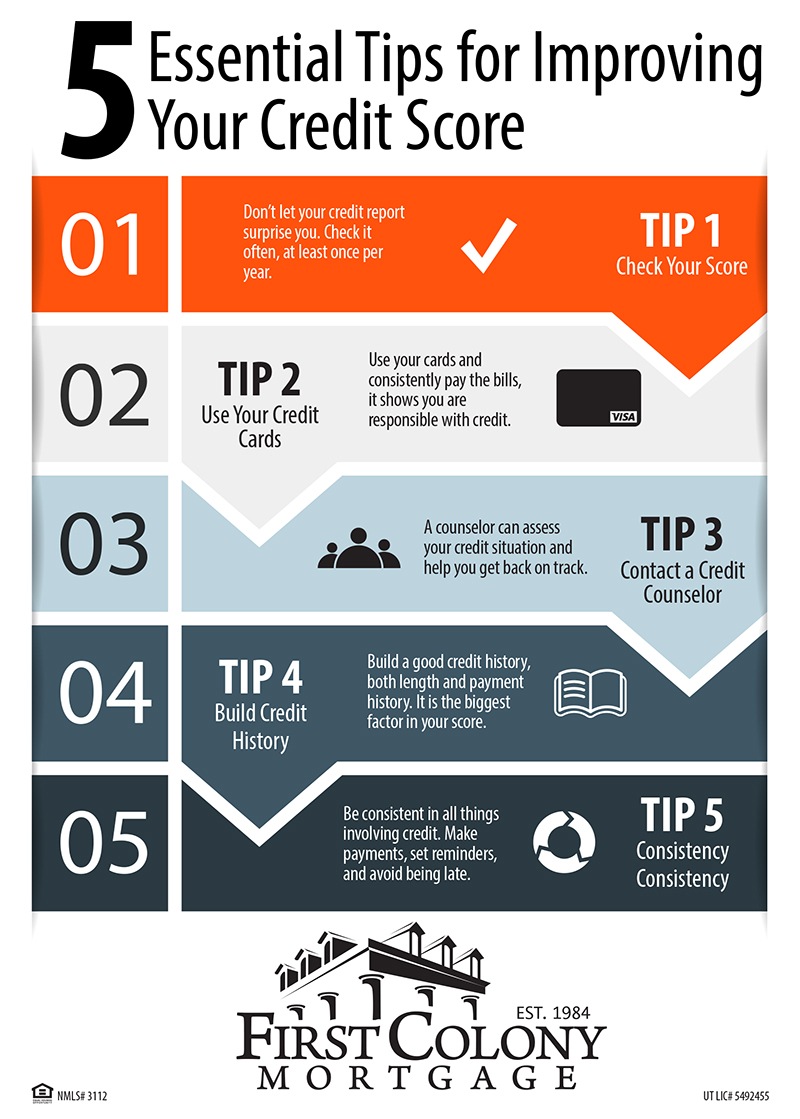

5 Tips To Improve Credit Scores вђў Utah Valley Moms Website builder are you thinking about purchasing a home? knowing and improving your credit score should be on your list of things to do before you start looking for a home. no matter what lender you finance with, one of the first things they will do is pull your credit report and break down every […]. A better credit score can expand your access to credit and make borrowing more affordable. for example, having a score of 700 versus 650 could mean getting approved for a new car loan at 4.9%.

How To Improve Your Credit Score Credit Whatever the reason, here are seven things you can do to bring that score up—and keep it there. 1. pay your bills on time. late payments or missing payments can lower your score more than any other factor. making regular, on time payments is one of the best ways to bring it back up. 5 tips to raise your credit score fast. 1. pay off or at least pay down your balances. paying off your balances might not be the easiest option, but the hard way could be the best for your. The brand of credit score used in more than 90 percent of consumer credit decisions, the fico score, typically ranges from a low of 350 to a high of 850; good scores begin in the mid to high 600s. If your credit card limit is $1,000, you can spend $300. if you spend more than 30% of your limit, that hurts your credit. so if you have a good credit score and you want to maintain it, spending.

How To Increase Your Credit Score In 5 Easy Steps Creditsoup The brand of credit score used in more than 90 percent of consumer credit decisions, the fico score, typically ranges from a low of 350 to a high of 850; good scores begin in the mid to high 600s. If your credit card limit is $1,000, you can spend $300. if you spend more than 30% of your limit, that hurts your credit. so if you have a good credit score and you want to maintain it, spending. 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest. Diversify the types of credit you have. 5. limit new credit applications. 6. dispute inaccurate information on your credit report. 7. become an authorized user. there are several ways you can improve your credit score, including making on time payments, paying down balances, avoiding unnecessary debt and more.

How To Build Ur Credit Score Outsiderough11 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest. Diversify the types of credit you have. 5. limit new credit applications. 6. dispute inaccurate information on your credit report. 7. become an authorized user. there are several ways you can improve your credit score, including making on time payments, paying down balances, avoiding unnecessary debt and more.

How To Quickly Improve My Credit Score Phaseisland17

Comments are closed.