5 Best Personal Finance Tips And Tricks For Millennials

5 Best Personal Finance Tips And Tricks For Millennials As millennials continue to navigate their financial journeys, understanding key tax and personal finance topics is crucial for achieving long term prosperity. in this article, we'll explore some of the most important issues facing millennials today, providing valuable insights and strategies to help them make informed decisions about their finances. 1. the importance of time value of money. Regardless of whether you’re working with an advisor or going it alone, these tips can help you get closer to your financial vision. 1. clarify your goals. when you’re talking about financial planning for millennials, it’s important to identify what your goals are. goals can be short or long term, broad or narrow.

The 5 Concepts All Millennials Need To Know To Win With Money 44. understand the basics of taxes. 45. find your net worth. the best financial advice i can give you. 45 personal finance tips for your financial well being. 1. make budgeting your priority. financial expert dave ramsey says “a budget is telling your money where to go instead of wondering where it went”. Tip #4: focus on paying off high interest debt. high interest debt, such as credit cards and personal loans, can put a serious dent in your finances. millennials have learned the hard way that. A salary increase from $43,000 to $49,000 a year looks like an extra $6,000 per year or $500 per month, but the tax rate will be higher, so it will only give you $4,469, or $372 per month. 7. Millennials spend an average of $85 a day, accounting for 28% of all daily per person consumer spending in the united states. this number is expected to climb as high as 35% over the next 15 years.

5 Financial Planning Tips For Millennials Nasdaq A salary increase from $43,000 to $49,000 a year looks like an extra $6,000 per year or $500 per month, but the tax rate will be higher, so it will only give you $4,469, or $372 per month. 7. Millennials spend an average of $85 a day, accounting for 28% of all daily per person consumer spending in the united states. this number is expected to climb as high as 35% over the next 15 years. A quick calculation to determine how much money millennials need to save for retirement is known as the 4% rule. millennials should estimate how much money they would like in retirement per year. This allows you to build a larger and larger balance over time — even without extra capital investment. for example, if you invested $6,000 per year when you were 25 years old, and earned $100.

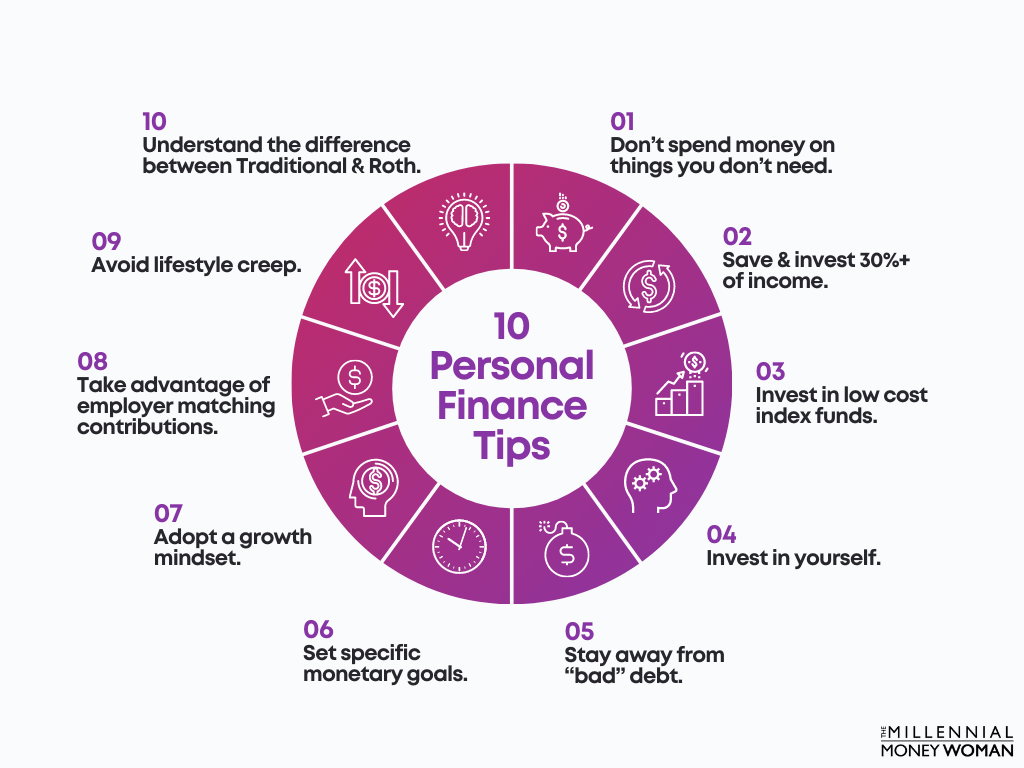

10 Personal Finance Tips That Will Transform Your Life A quick calculation to determine how much money millennials need to save for retirement is known as the 4% rule. millennials should estimate how much money they would like in retirement per year. This allows you to build a larger and larger balance over time — even without extra capital investment. for example, if you invested $6,000 per year when you were 25 years old, and earned $100.

Comments are closed.