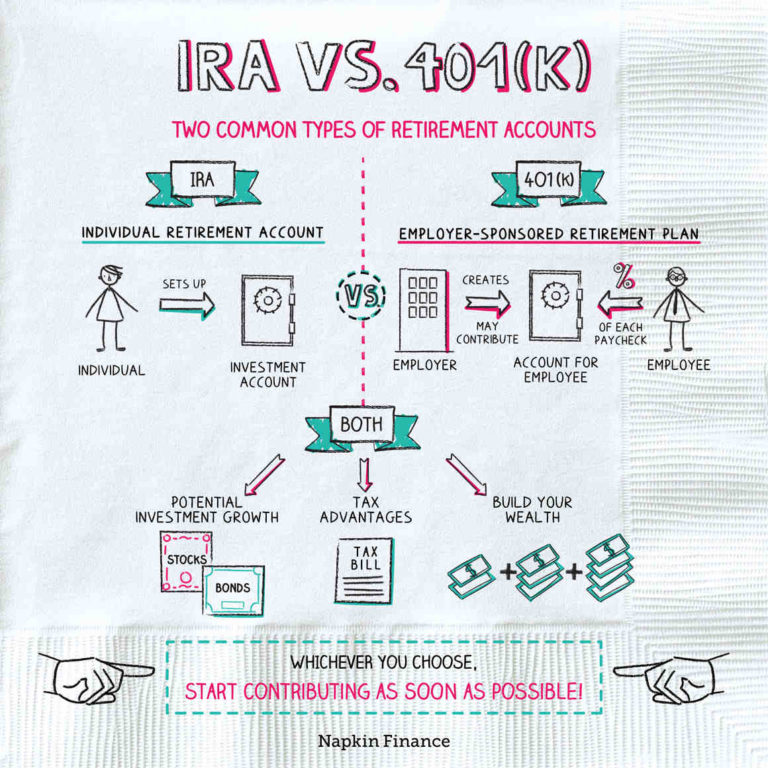

401k Vs Roth Ira How To Use These Accounts To Build Wealth

401k Vs Roth Ira Explained Which Is Better How To Build Wealth Contribution limits for roth iras and roth 401 (k)s are very different. you can potentially save much more per year using a roth 401 (k) than a roth ira. here’s how the contribution limits compare for 2023: roth ira. under age 50: $6,500. age 50 : $7,500. roth 401 (k) under age 50: $22,500. age 50 : $30,000. Let’s say your company offers a 3% match ($1,800). you invest $1,800 in your 401 (k) to reach the employer match. this leaves you with $7,200 more to invest. then max out your roth ira. you can only contribute $7,000 in 2024, so that leaves you with $200. return to your 401 (k) and invest the remaining $200.

401k Vs Roth Ira Can They Work Together Wealth Nation In contrast, roth iras do not provide a front end tax benefit, meaning employee contributions to roth iras are not deductible. but unlike traditional iras, roth ira distributions come out tax free. Roth 401 (k) is best for you (or you can contribute to both types of accounts). in 2024, the annual contribution limit is $23,000 ($30,500 for those age 50 ). the max contribution for a roth ira. The roth 401 (k) has a number of key differences from the roth ira. here’s what to know before deciding which account is right for you. 1. contribution limits. the most distinguishing. Higher contribution limits: in 2023, you can stash away up to $22,500 in a roth 401 (k)—$30,000 if you're age 50 or older. 2 roth ira contributions, by comparison, are capped at $6,500—$7,500 if you're 50 or older. matching contributions: roth 401 (k)s are eligible for matching contributions from your employer, if offered.

Can I Have A Roth Ira And A 401k Investment Finance News The roth 401 (k) has a number of key differences from the roth ira. here’s what to know before deciding which account is right for you. 1. contribution limits. the most distinguishing. Higher contribution limits: in 2023, you can stash away up to $22,500 in a roth 401 (k)—$30,000 if you're age 50 or older. 2 roth ira contributions, by comparison, are capped at $6,500—$7,500 if you're 50 or older. matching contributions: roth 401 (k)s are eligible for matching contributions from your employer, if offered. Key takeaways. both roth iras and 401 (k)s allow your savings to grow tax deferred. many employers offer a 401 (k) match, which matches your contributions up to a specific percentage of your. Roth individual retirement accounts (iras) have been around since 1997. roth 401 (k)s began in 2001. a roth 401 (k) has higher contribution limits and allows employers to make matching.

Roth Ira Vs 401k Choosing Your Gold Ira Key takeaways. both roth iras and 401 (k)s allow your savings to grow tax deferred. many employers offer a 401 (k) match, which matches your contributions up to a specific percentage of your. Roth individual retirement accounts (iras) have been around since 1997. roth 401 (k)s began in 2001. a roth 401 (k) has higher contribution limits and allows employers to make matching.

Roth Ira Vs Roth 401k Choosing Your Gold Ira

Comments are closed.