3 Consumer Staples Sector Companies At Fair Value Youtube

3 Consumer Staples Sector Companies At Fair Value Youtube All valuation calculators video: youtu.be uroibkzay3yrumble : investing rumble c c 965347 gaming rumble c c 969787 i. Food and beverage. food staples include companies that make cereals, snacks and other dry goods. beverages can include alcohol but are more often colas and energy drinks. household products.

Consumer Staples Sector Preview Reporting Season February 2024 Youtube Second, scheuneman says incoming ceo sue y. nabi has 20 years of experience at l'oreal and has already laid out a clear strategy, including expanding its luxury unit and emphasizing digital sales. Pg is the top ranked stock in the consumer staples sector and is the only stock rated exceptional. the stock yields a respectable 2.58%, but its 5 year dgr is relatively low at only 3.6%. the. Why we raised apple stock's fair value estimate, economic moat rating. apple stock’s fair value estimate is now us$150, and its economic moat rating is 'wide.' the 10 best companies to invest in now. the undervalued stocks of high quality companies are compelling investments today. three u.s. banks powering through geopolitical jitters. Current industry pe. investors are optimistic on the american consumer staples industry, and appear confident in long term growth rates. the industry is trading at a pe ratio of 31.7x which is higher than its 3 year average pe of 27.7x. the industry is trading close to its 3 year average ps ratio of 1.2x. past earnings growth.

What Are Consumer Staples Stocks Marketbeat Why we raised apple stock's fair value estimate, economic moat rating. apple stock’s fair value estimate is now us$150, and its economic moat rating is 'wide.' the 10 best companies to invest in now. the undervalued stocks of high quality companies are compelling investments today. three u.s. banks powering through geopolitical jitters. Current industry pe. investors are optimistic on the american consumer staples industry, and appear confident in long term growth rates. the industry is trading at a pe ratio of 31.7x which is higher than its 3 year average pe of 27.7x. the industry is trading close to its 3 year average ps ratio of 1.2x. past earnings growth. The consumer staples sector has a total of 246 stocks, with a combined market cap of $4,193.66 billion, total revenue of $2,896.56 billion and a weighted average pe ratio of 30.42. market cap. Best consumer staples stocks to buy in 2024. just as you’re familiar with many consumer staples products, you’ll likely be familiar with many of the top stocks in the sector such as procter.

7 Best Consumer Staples Sector Dividend Stocks Dividend Strategists The consumer staples sector has a total of 246 stocks, with a combined market cap of $4,193.66 billion, total revenue of $2,896.56 billion and a weighted average pe ratio of 30.42. market cap. Best consumer staples stocks to buy in 2024. just as you’re familiar with many consumer staples products, you’ll likely be familiar with many of the top stocks in the sector such as procter.

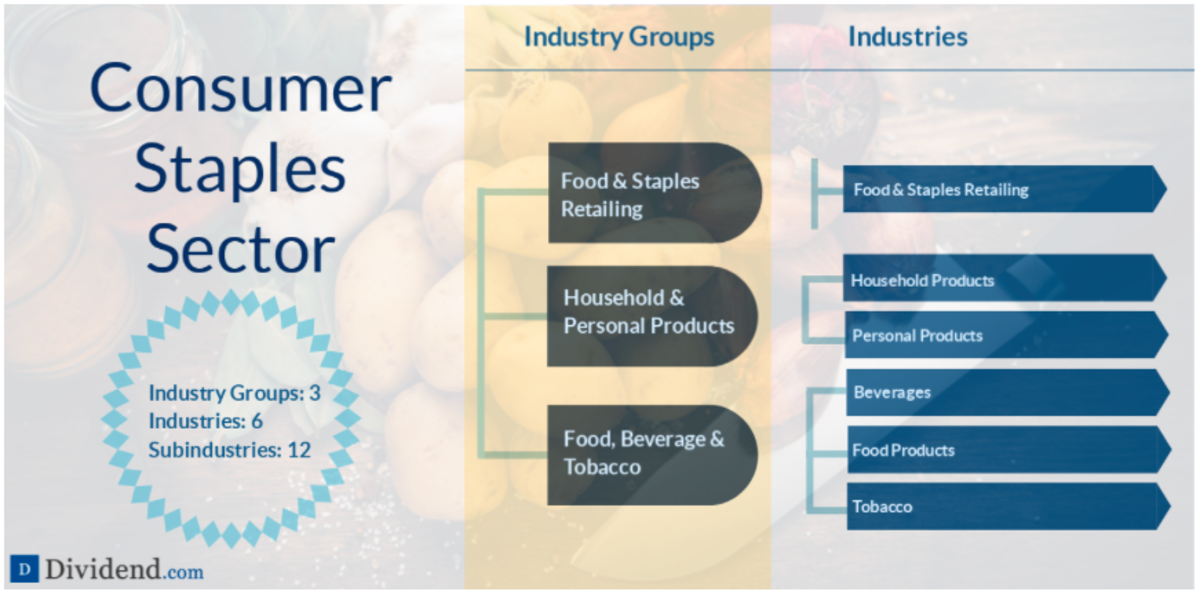

Breaking Down The Consumer Staples Sector

Comments are closed.