2024 Irs 401k Limits Tine Maurizia

401k Limits 2024 Table Irs Merla Rachel Ir 2023 203, nov. 1, 2023. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. the irs today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for. The 2024 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2023. those 50 and older can contribute an additional $7,500. use our calculator to estimate your future balance.

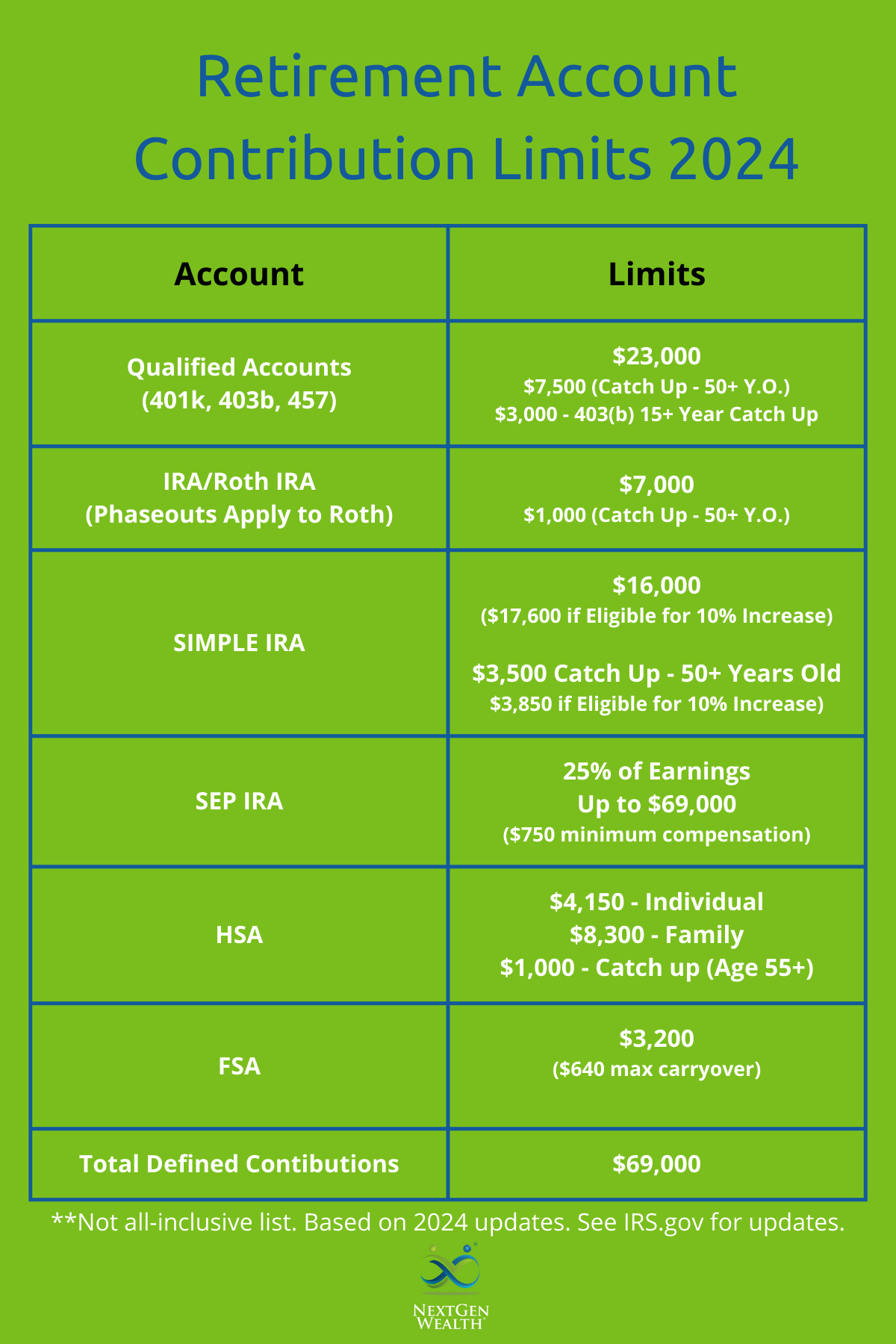

Roth 401k 2024 Contribution Limit Irs Gov Adel Maurizia The 2024 401 (k) individual contribution limit is $23,000, up from $22,500 in 2023. in 2024, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2023. if you are 50 years old or older, you can also contribute up to $7,500 in "catch up" contributions on top of your individual and employer contributions. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. Here's how the 401 (k) plan limits will change in 2024: the 401 (k) contribution limit is $23,000. the 401 (k) catch up contribution limit is $7,500 for those 50 and older. the limit on employer. 401 (k) contribution limits for 2024. workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2024, a $500.

401k Limits 2024 Include Employer Match Bonus Opal Ophelia Here's how the 401 (k) plan limits will change in 2024: the 401 (k) contribution limit is $23,000. the 401 (k) catch up contribution limit is $7,500 for those 50 and older. the limit on employer. 401 (k) contribution limits for 2024. workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2024, a $500. The dollar limitations for retirement plans and certain other dollar limitations that become effective january 1, 2024, have been released by the irs in notice 2023 75. the dollar limitations adjusted by reference to irc section 415(d) are modified annually for inflation and, consequently, most of them are changed for 2024. The irs also imposes a limit on all 401 (k) contributions made during the year. these limits increase to $69,000 and $76,500, respectively, in 2024. in 2023, the limits were $66,000, or $73,500.

Roth 401k 2024 Contribution Limit Irs Gov Adel Maurizia The dollar limitations for retirement plans and certain other dollar limitations that become effective january 1, 2024, have been released by the irs in notice 2023 75. the dollar limitations adjusted by reference to irc section 415(d) are modified annually for inflation and, consequently, most of them are changed for 2024. The irs also imposes a limit on all 401 (k) contributions made during the year. these limits increase to $69,000 and $76,500, respectively, in 2024. in 2023, the limits were $66,000, or $73,500.

What Is The 401k Limit For 2024 Irs Catch Up Dinah Flossie

Comments are closed.