2024 Income Limits And Max Contribution Limits For Ira 401k H

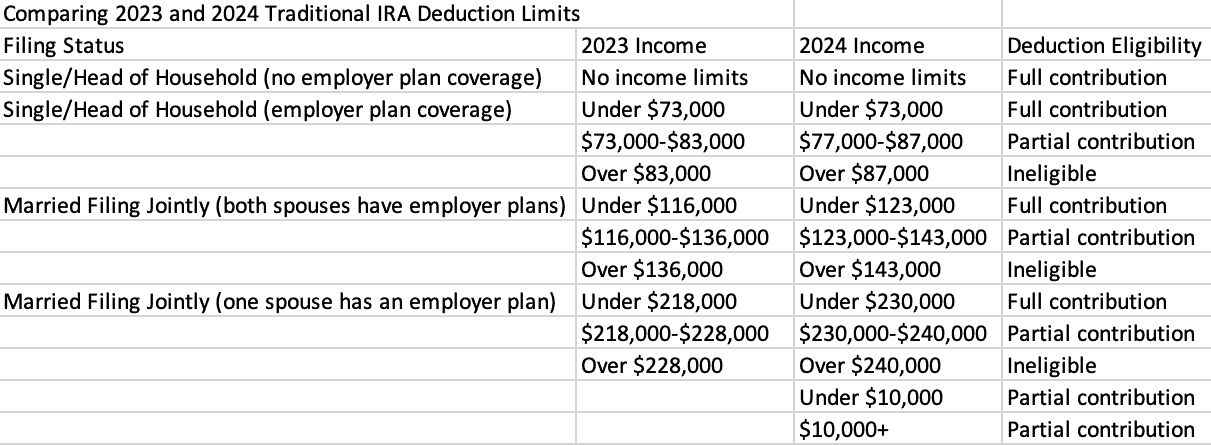

401k 2024 Maximum Limits Jodie Rosabella You can soon save more money for retirement, thanks to an increase in IRA and 401(k) contribution limits for 2024 Contribution limits along with many other tax provisions are adjusted for The income limits for 2023 and 2024 are: There are two components to consider in calculating the amount you can contribute to a Roth IRA The first consideration is the overall IRA contribution limit

401k 2024 Contribution Limit Chart Finding a financial advisor doesn't have to be hard SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes Each advisor has been vetted Read on to learn about the 2024 IRA contribution limits and other rules you should know The IRS adjusts the IRA contribution and income limits every year for inflation Adjustments usually occur “The income limits only apply to freestanding Roths,” she pointed out How to calculate your reduced Roth IRA contribution The IRS provides instructions for how to calculate the amount of your you and your spouse are still each able to contribute up to the maximum contribution or your total annual income, whichever is less In addition, the Roth IRA places income limits on who can

Comments are closed.