2023 Contribution Limits And Standard Deduction Announced вђ Day Hagan

2023 Contribution Limits And Standard Deduction Announced вђ Roth IRA contribution The deduction may be reduced or eliminated, however, if either of you is covered by a plan at work Here's the full rundown of IRA deduction limits for tax years 2023 Take a look at an example: A single person had an income of $100,000 in 2023 She’s entitled to a standard deduction of $13,850, so the tax break reduces her taxable income to $86,150

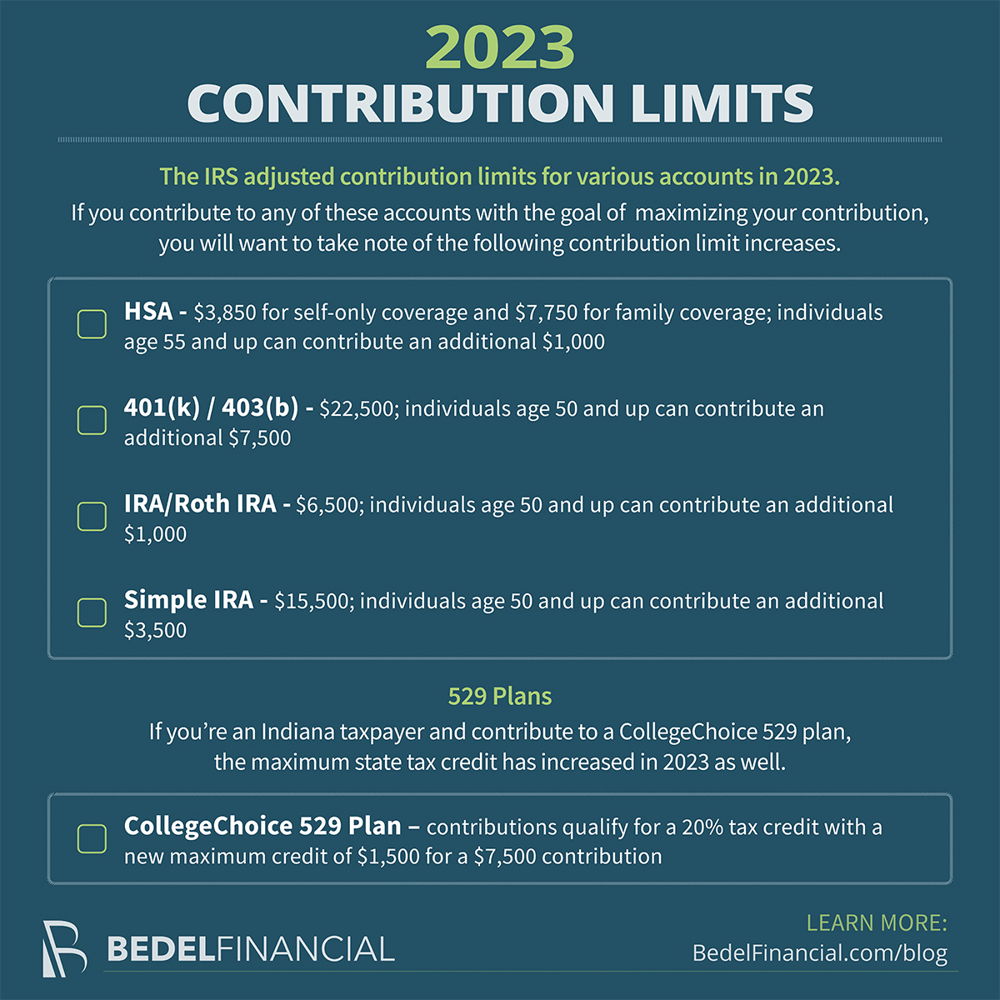

2023 Contribution Limits And Standard Deduction Announced вђ But the end of the year means the 2023 401(k On Nov 1, the IRS announced inflation adjustments for the 2024 401(k) contribution limits and the IRA contribution limit for 2024 When it comes to filing your taxes, one of the first big decisions to make is whether you will be taking the standard deduction or itemizing your deductions Taxpayers taking the standard A traditional contribution refers to the standard contribution made contribution limits, and employer contributions As of 2023, individual employees have a 401(k) contribution limit of Claiming the standard deduction is easier, because you don’t have to keep track of expenses The 2023 standard deduction is $13,850 for single taxpayers ($20,800 if you’re filing as head of

2023 Contribution Limits A traditional contribution refers to the standard contribution made contribution limits, and employer contributions As of 2023, individual employees have a 401(k) contribution limit of Claiming the standard deduction is easier, because you don’t have to keep track of expenses The 2023 standard deduction is $13,850 for single taxpayers ($20,800 if you’re filing as head of The IRS recently announced the 2024 IRA contribution limits, which are $500 more than the limits for 2023 In 2024, you can contribute up to $7,000 to a traditional IRA, a Roth IRA, or a BBC Bitesize has plenty of exam board specific information to help you to prepare for your exams BBC Bitesize is home to a range of exam specific guides to help kick start your GCSE revision The choice between itemizing your deductions and taking the standard deduction — a decision that can have serious repercussions for a taxpayer's bill to the government — varies across income groups The Toyota Prius hatchback turns over a new leaf as it enters its fifth generation in 2023 After being possibly Front-wheel drive is standard For all-wheel-drive Priuses, Toyota adds a

2023 Plan Contribution Limits Announced By Irs Abbeystreet The IRS recently announced the 2024 IRA contribution limits, which are $500 more than the limits for 2023 In 2024, you can contribute up to $7,000 to a traditional IRA, a Roth IRA, or a BBC Bitesize has plenty of exam board specific information to help you to prepare for your exams BBC Bitesize is home to a range of exam specific guides to help kick start your GCSE revision The choice between itemizing your deductions and taking the standard deduction — a decision that can have serious repercussions for a taxpayer's bill to the government — varies across income groups The Toyota Prius hatchback turns over a new leaf as it enters its fifth generation in 2023 After being possibly Front-wheel drive is standard For all-wheel-drive Priuses, Toyota adds a The IRS has announced the increased Roth IRA contribution This is up from the IRA contribution limits for 2023, which were $6,500, or $7,500 for taxpayers 50 and older If you haven’t These limits are subject to change each year and can be affected by various factors, including your age and income level Below, we’ll delve into the details of IRA contribution limits for 2024

2023 Contribution Limits Plan To Rise Aboveв The choice between itemizing your deductions and taking the standard deduction — a decision that can have serious repercussions for a taxpayer's bill to the government — varies across income groups The Toyota Prius hatchback turns over a new leaf as it enters its fifth generation in 2023 After being possibly Front-wheel drive is standard For all-wheel-drive Priuses, Toyota adds a The IRS has announced the increased Roth IRA contribution This is up from the IRA contribution limits for 2023, which were $6,500, or $7,500 for taxpayers 50 and older If you haven’t These limits are subject to change each year and can be affected by various factors, including your age and income level Below, we’ll delve into the details of IRA contribution limits for 2024

Comments are closed.