2019 Fsa And Hsa Contribution Limits

2019 Fsa And Hsa Contribution Limits The maximum annual hsa contribution based on your hdhp coverage (self only or family) on the first day of the last month of your tax year. if you had family hdhp coverage on the first day tip of the last month of your tax year, your contribu tion limit for 2019 is $7,000 even if you changed coverage during the year. Health flexible spending arrangement (fsa) contribution and carryover for 2023. revenue procedure 2022 38, october 18, 2022, provides that for tax years beginning in 2023, the dollar limitation under section 125(i) on voluntary employee salary reductions for contributions to health flexible spending arrangements is $3,050.

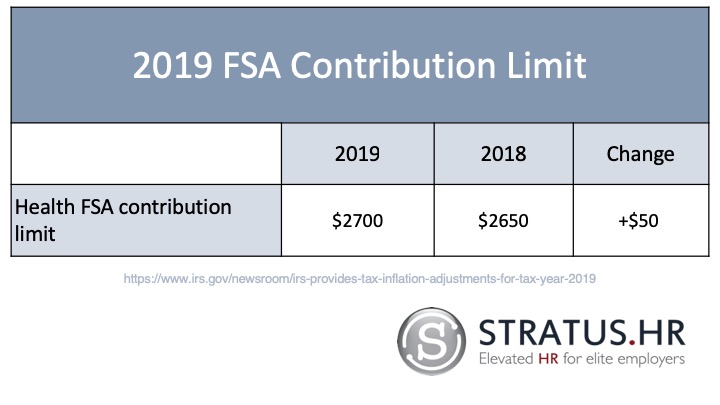

2019 Fsa And Hsa Contribution Limits Health flexible spending arrangement (fsa) contri bution and carryover for 2023. revenue procedure 2022 38, october 18, 2022, provides that for tax years be ginning in 2023, the dollar limitation under section 125(i) on voluntary employee salary reductions for contributions to health flexible spending arrangements is $3,050. Hsa contribution limits 2019. for 2019, the internal revenue service raised the maximum contribution to hsas by $50 to $3,500 for individuals and $100 to $7,000 for families. maximum catch up. The irs has announced the 2019 contribution limits for health flexible spending accounts (fsa), as well as limits for health savings accounts (hsa) for those with a qualifying high deductible health plan (hdhp). for 2019, health fsa contribution limits will cap at $2,700 (an increase of $50 from 2018), and hsa limits will be at $3,500 for self. The 2019 versions of form 8889 and its instructions are substantially similar to their 2018 counterparts. they have been updated to reflect the 2019 hsa contribution limits (see our checkpoint article) and the deadline in 2020 for making hsa contributions for 2019. they also add references to new form 1040 sr for seniors, and revise line and.

2019 Fsa And Hsa Contribution Limits The irs has announced the 2019 contribution limits for health flexible spending accounts (fsa), as well as limits for health savings accounts (hsa) for those with a qualifying high deductible health plan (hdhp). for 2019, health fsa contribution limits will cap at $2,700 (an increase of $50 from 2018), and hsa limits will be at $3,500 for self. The 2019 versions of form 8889 and its instructions are substantially similar to their 2018 counterparts. they have been updated to reflect the 2019 hsa contribution limits (see our checkpoint article) and the deadline in 2020 for making hsa contributions for 2019. they also add references to new form 1040 sr for seniors, and revise line and. 2019 hsa contribution limits will increase to $3,500 for single (an increase of $50) and $7,000 for family (an increase of $100). as a reminder, the 2018 family hsa contribution limit also recently increased to $6,900 with the update released by the irs on april 26, 2018. Hsa holders can choose to save up to $3,500 for an individual and $7,000 for a family (hsa holders 55 and older get to save an extra $1,000 which means $4,500 for an individual and $8,000 for a family) – and these contributions are 100% tax deductible from gross income. minimum annual deductibles are $1,350 for self only coverage or $2,700.

Irs Announces Hsa Limits For 2019 Sima Financial Group 2019 hsa contribution limits will increase to $3,500 for single (an increase of $50) and $7,000 for family (an increase of $100). as a reminder, the 2018 family hsa contribution limit also recently increased to $6,900 with the update released by the irs on april 26, 2018. Hsa holders can choose to save up to $3,500 for an individual and $7,000 for a family (hsa holders 55 and older get to save an extra $1,000 which means $4,500 for an individual and $8,000 for a family) – and these contributions are 100% tax deductible from gross income. minimum annual deductibles are $1,350 for self only coverage or $2,700.

Comments are closed.