2018 Retirement Plan Limits Announced By Irs Moneytree Software

2018 Retirement Plan Limits Announced By Irs Moneytree Software January 1, 2018. the irs said that the limit on elective deferral for contributions to 401 (k) plans, 403 (b) plans, most 457 plans, and the federal government's thrift savings plan has increased from $18,000 in 2017 to $18,500 for 2018. however, the catch up contribution limit for those 50 and older remains $6,000 (notice 2017 64). most. 2018 limitations adjusted as provided in section 415(d), etc. notice 2017 64 . section 415 of the internal revenue code (the code) provides for dollar limitations on benefits and contributions under qualified retirement plans. section 415(d) requires that the secretary of the treasury annually adjust these limits for cost of living increases. other.

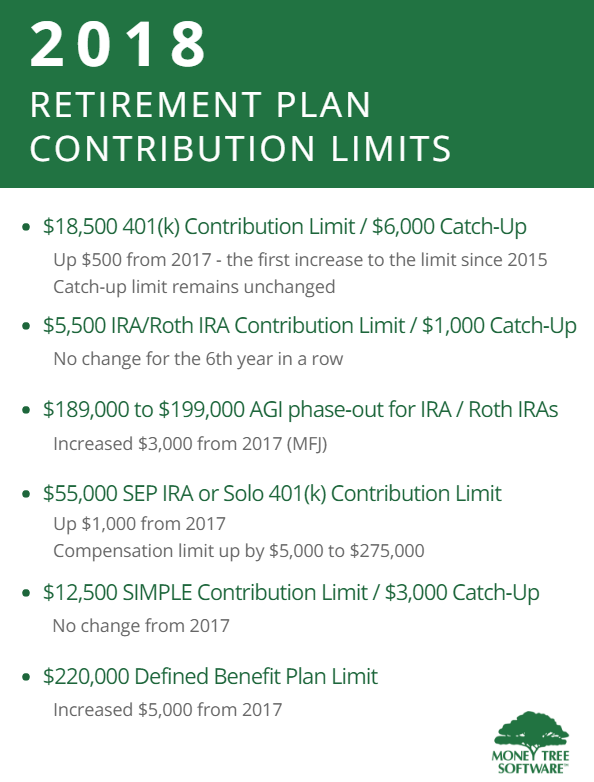

2018 Irs Contribution Limits Below is a summary of the limits that are generally relevant for most retirement plans. effective january 1, 2018: the elective deferral limit for 401(k), 403(b) and eligible 457(b) plans is increased from $18,000 to $18,500. the catch up contribution limit for those age 50 or older remains unchanged at $6,000. the dollar limit on the annual. 401 (k), 403 (b), 457, and thrift savings plan contribution limits. for 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants. The irs has released notice 2017 64 announcing cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement related items for tax year 2018. highlights affecting plan sponsors of qualified plans for 2018. the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal. The irs on oct. 19 announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for tax year 2018. the 2018 limits are contained in notice 2017 64.increased limitsthe irs has increased the following limits for 2018 from 2017 levels:.

Irs Raises Several Annual Retirement Plan Limits For 2018 The irs has released notice 2017 64 announcing cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement related items for tax year 2018. highlights affecting plan sponsors of qualified plans for 2018. the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal. The irs on oct. 19 announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for tax year 2018. the 2018 limits are contained in notice 2017 64.increased limitsthe irs has increased the following limits for 2018 from 2017 levels:. Catch up contribution limit for simple iras. remains unchanged at $3,000. annual additions limit for defined contribution plans. increases from $54,000 to $55,000. annual additions limit for defined benefit plans. increases from $215,000 to $220,000. social security wage base. increases from $127,200 to $128,700. The irs on thursday announced 2018 contribution limits for retirement accounts, the result of cost of living adjustments. the limit on elective deferral for contributions to 401(k) plans, 403(b) plans, most 457 plans, and the federal government’s thrift savings plan will increase from $18,000 in 2017 to $18,500 for 2018.

Comments are closed.