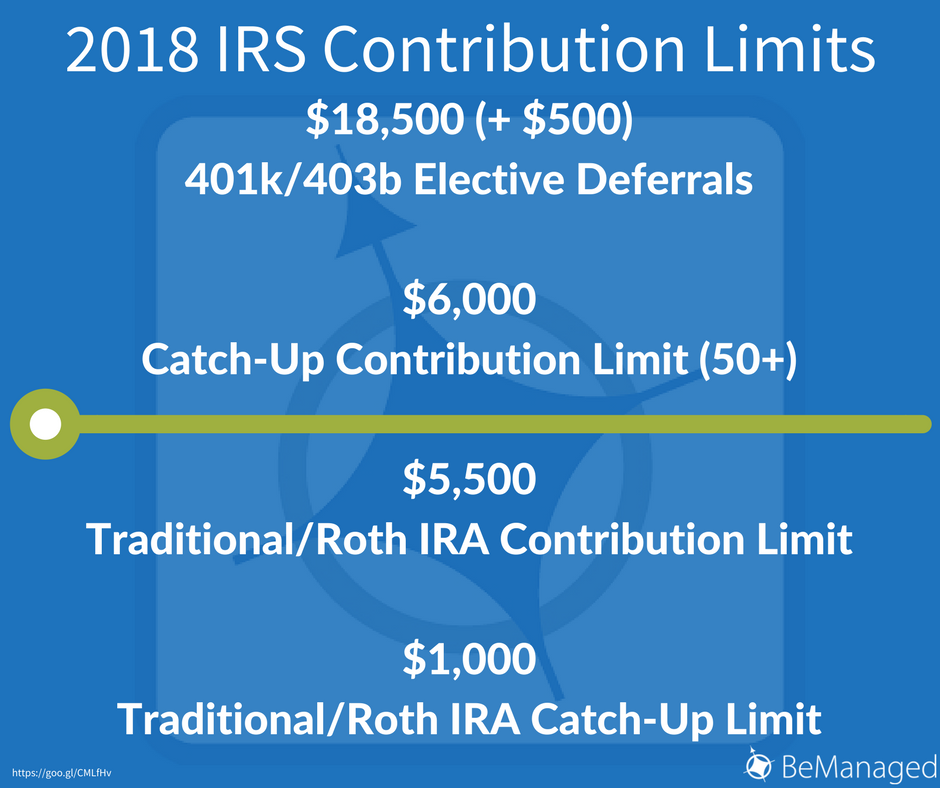

2018 Irs Contribution Limits

2018 Irs Contribution Limits For your tax filing status, if your agi is less than the full contribution limit, you can contribute up to $5,500 or $6,500, depending on your age, to a roth ira for the 2018 tax year. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments.

Irs Announces 2018 Retirement Plan Contribution Limits The limit on traditional ira contributions for the 2018 tax year will be $5,500 for those younger than age 50, and $6,500 for those who are 50 or older. that's the same limit that's been in place. For your tax filing status, if your agi is less than the full contribution limit, you can contribute up to $5,500 or $6,500, depending on your age, to a roth ira for the 2018 tax year. Ira owners can still contribute up to $5,500 for the 2018 tax year, with an additional $1,000 catch up contribution allowed for individuals age 50 or older. contributions for 2018 can be made from. The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021. catch up contributions may also be allowed if the employee is age 50 or older. if the employee's total contributions exceed the deferral limit, the difference is included in the employee's.

2018 Irs Contribution Limits Ira owners can still contribute up to $5,500 for the 2018 tax year, with an additional $1,000 catch up contribution allowed for individuals age 50 or older. contributions for 2018 can be made from. The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021. catch up contributions may also be allowed if the employee is age 50 or older. if the employee's total contributions exceed the deferral limit, the difference is included in the employee's. Contributions to a traditional ira are usually tax deductible, and distributions are generally taxable. to count for a 2018 tax return, contributions must be made by april 15, 2019 (april 17, 2019 for residents of maine and massachusetts). taxpayers can file their return claiming a traditional ira contribution before the contribution is. The limit on traditional ira contributions for the 2018 tax year will be $5,500 for those younger than age 50, and $6,500 for those who are 50 or older. that's the same limit that's been in place.

Irs Announces 2018 Contribution Benefits Limits Emplicity Peo Hr Contributions to a traditional ira are usually tax deductible, and distributions are generally taxable. to count for a 2018 tax return, contributions must be made by april 15, 2019 (april 17, 2019 for residents of maine and massachusetts). taxpayers can file their return claiming a traditional ira contribution before the contribution is. The limit on traditional ira contributions for the 2018 tax year will be $5,500 for those younger than age 50, and $6,500 for those who are 50 or older. that's the same limit that's been in place.

Irs Increases 401k Contribution Limits For 2018 Bemanaged

Comments are closed.