2018 Ira Limits Chart Keski

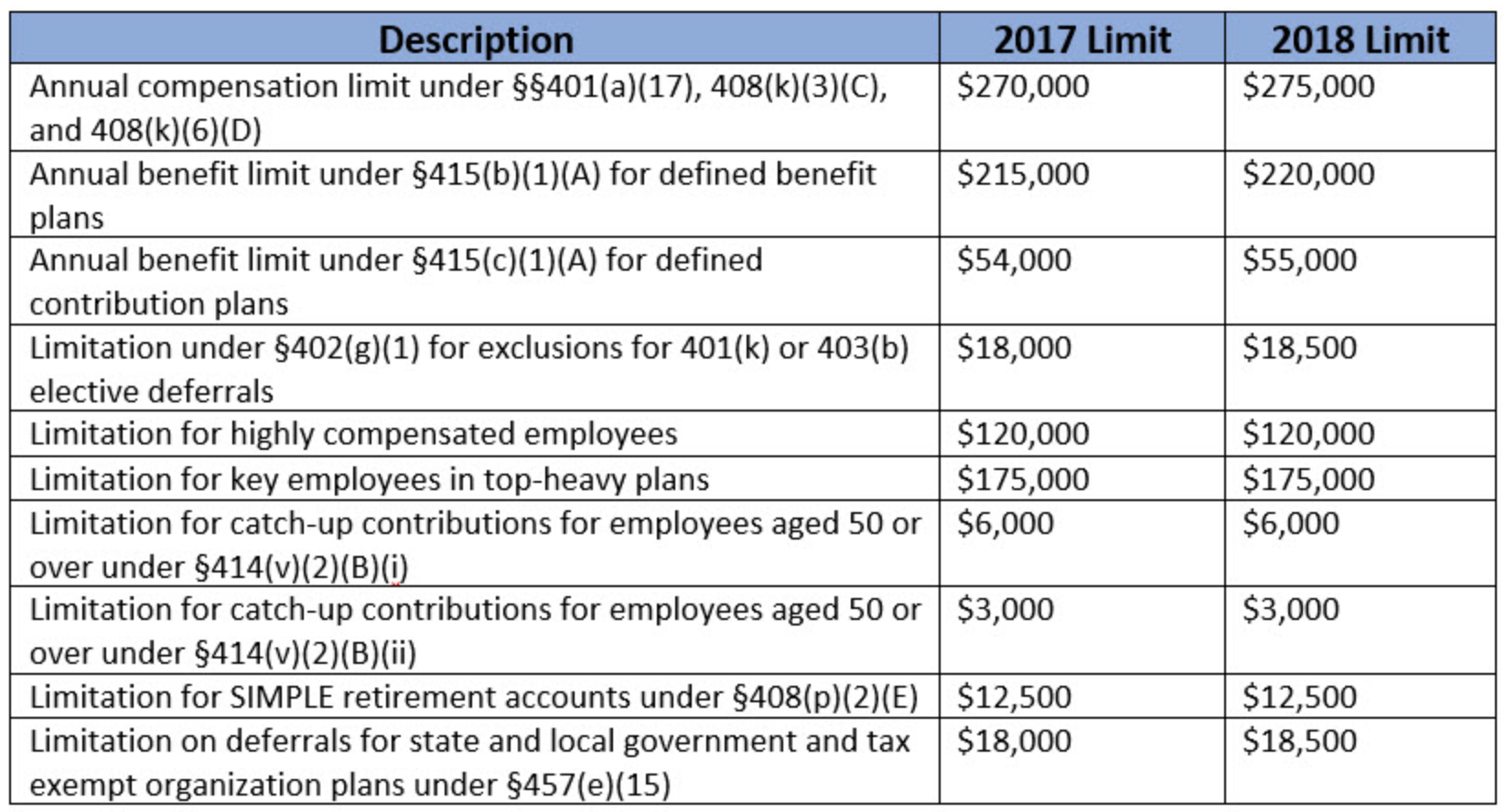

2018 Ira Limits Chart Keski That is a combined maximum, which means the limit is the same if you have more than one IRA You can only contribute earned income to an IRA Roth IRA contribution limits are reduced or eliminated Everything you need to know about Roth IRA income limits and contribution limits Jean The IRS provides a detailed chart of the Saver’s Credit The tax credit percentage is calculated using

2018 Ira Limits Chart Keski You can soon save more money for retirement, thanks to an increase in IRA and 401(k) contribution limits for 2024 Contribution limits along with many other tax provisions are adjusted for “The income limits only apply to freestanding Roths,” she pointed out How to calculate your reduced Roth IRA contribution The IRS provides instructions for how to calculate the amount of your but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a traditional IRA to a Roth is entirely legal and sanctioned by the IRS There are several IRA options Tax advantages will vary based on the type of IRA Contribution limits may vary based on your age Retirement planning is an essential aspect of securing your

Comments are closed.