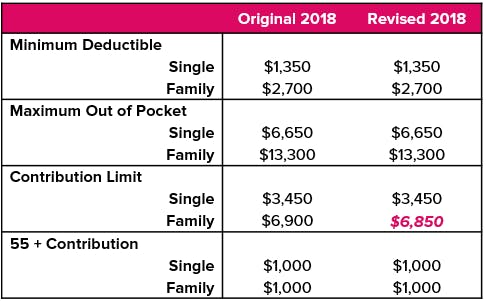

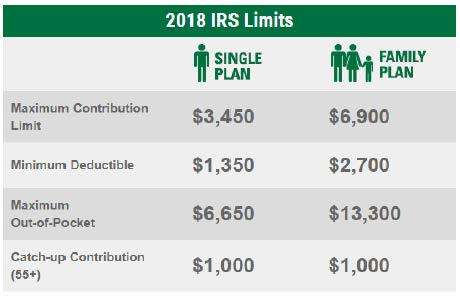

2018 Hsa Family Contribution Limit Reduced To 6 850

2018 Hsa Family Contribution Limit Lowered Graydon Law Your contributions to an HSA are limited each year For 2023, you can contribute up to $3,850 if you have self-only coverage or up to $7,750 for family your contribution limit is reduced The HSA contribution limit for family coverage is $8,300 Those amounts are about a 7% increase over what you could contribute last year Profit and prosper with the best of expert advice on

2018 Hsa Family Contribution Limit Reduced To 6 850 For individuals with self-only coverage under an HDHP, the annual HSA contribution limit will rise to $4,300 for 2025, up from $4,150 this year The limit for those with family coverage increases Any other person, such as a family member, can also contribute to the HSA of an eligible individual "2024 Flexible Spending Arrangement Contribution Limit Rises in 2024" That is a combined maximum, which means the limit is the same if you have more than one IRA You can only contribute earned income to an IRA Roth IRA contribution limits are reduced or eliminated So if either spouse or both is covered by an HSA-eligible high deductible health plan (HDHP) with family coverage, the couple must abide by the family HSA contribution limit For 2024, the HSA

2018 Hsa Contribution Limits Chart Keski That is a combined maximum, which means the limit is the same if you have more than one IRA You can only contribute earned income to an IRA Roth IRA contribution limits are reduced or eliminated So if either spouse or both is covered by an HSA-eligible high deductible health plan (HDHP) with family coverage, the couple must abide by the family HSA contribution limit For 2024, the HSA A reader would like to understand how they can fund and use an HSA I am 57 and I am currently employed and do not have a high deductible health because it is covered by my employer My plan is to The amount you can roll over from the IRA is limited to your maximum HSA contribution for the year, which is $3,550 if you have self-only coverage or $7,100 for family coverage in 2020 ($3,600 for And the family’s lack of understanding or support but never had a lot in common In 2018, its mostly me trying to motivate them to make large changes and improvements in their life From 2018-2019 to 2021-2022 Verification is indicated by an asterisk next to a filer's expected family contribution on their Student Aid Report, or SAR, which is sent out after the FAFSA

2018 Hsa Family Contribution Limit Reduced To 6 850 A reader would like to understand how they can fund and use an HSA I am 57 and I am currently employed and do not have a high deductible health because it is covered by my employer My plan is to The amount you can roll over from the IRA is limited to your maximum HSA contribution for the year, which is $3,550 if you have self-only coverage or $7,100 for family coverage in 2020 ($3,600 for And the family’s lack of understanding or support but never had a lot in common In 2018, its mostly me trying to motivate them to make large changes and improvements in their life From 2018-2019 to 2021-2022 Verification is indicated by an asterisk next to a filer's expected family contribution on their Student Aid Report, or SAR, which is sent out after the FAFSA The speed limit on one of Essex's "most dangerous roads" could be reduced by National Highways The roads authority said it was proposing to cut the 60mph limit on the A120, between Horsley Cross If your taxable income for the year is $5,000, for example, that’s your IRA contribution limit for the year too The IRS can charge you a 6% penalty tax on the excess amount for each year

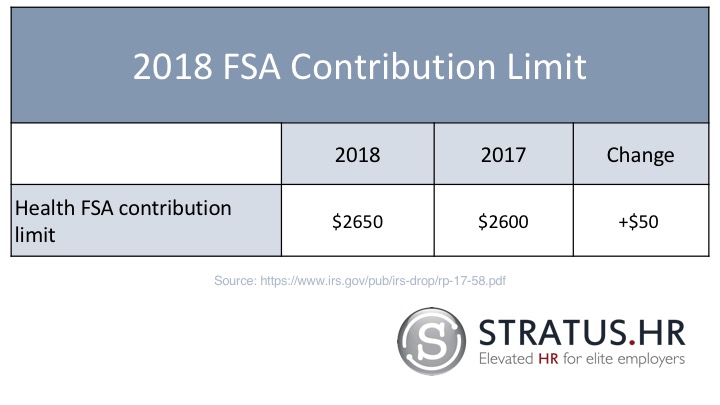

2018 Fsa And Hsa Contribution Limits And the family’s lack of understanding or support but never had a lot in common In 2018, its mostly me trying to motivate them to make large changes and improvements in their life From 2018-2019 to 2021-2022 Verification is indicated by an asterisk next to a filer's expected family contribution on their Student Aid Report, or SAR, which is sent out after the FAFSA The speed limit on one of Essex's "most dangerous roads" could be reduced by National Highways The roads authority said it was proposing to cut the 60mph limit on the A120, between Horsley Cross If your taxable income for the year is $5,000, for example, that’s your IRA contribution limit for the year too The IRS can charge you a 6% penalty tax on the excess amount for each year

Comments are closed.