2018 Hsa Family Contribution Limit Lowered Graydon Law

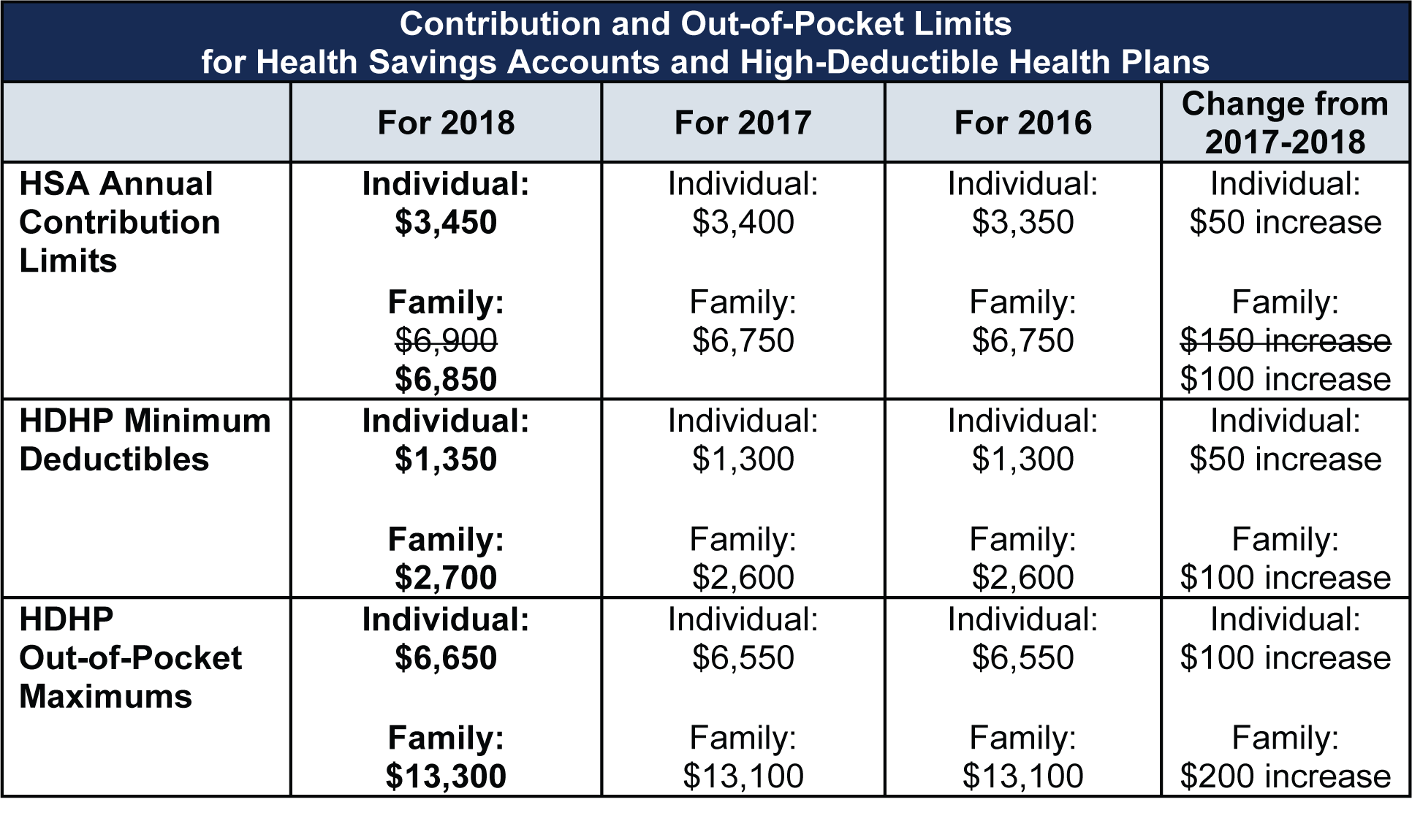

2018 Hsa Family Contribution Limit Lowered Graydon Law However, since the hsa contribution limits were already announced for 2018, most people (including myself) believed the irs wouldn’t adjust the 2018 limits. i was wrong. this week the irs issued a revenue procedure that changed the 2018 family hsa contribution amount. the family contribution limit is now $6,850. This is an update to our march blogpost, where we alerted employers that the 2018 family hsa contribution limit was lowered from $6,900 to $6,850 due to the tax cuts and jobs act making an inflation adjustment. the irs is reversing course now for a second time, and the family hsa contribution limit will again be $6,900 for 2018. the irs cited.

2018 Hsa Family Contribution Limit Reduced To 6 850 2019: $13,500. health fsa limit on pre tax contributions. $2,650. dependent care fsa tax exclusion. $2,500. married filing separately. $5,000. married filing jointly. in march of this year, the irs adjusted the 2018 hsa contribution limit for individuals enrolled in family coverage down $50 from $6,900 to $6,850. This is an update to our march blogpost, where we alerted employers that the 2018 family hsa contribution limit was lowered from $6,900 to $6,850 due… toggle navigation search. This week the irs issued a revenue procedure that changed the 2018 family hsa contribution amount. the family contribution limit is now $6,850. the family contribution limit is now $6,850. it was. Revenue procedure 2018 27 modifies guidance issued by the irs earlier this year (revenue procedure 2018 18), in response to december 2017 tax reform legislation, under which the irs had reduced the hsa contribution limit for individuals with family hdhp coverage from $6,900 to $6,850 for 2018 (tax cuts and jobs act, pub. l. no. 115 97 (2017)).

Hsa 2018 Contribution Limits Adjusted By Irs Medcost This week the irs issued a revenue procedure that changed the 2018 family hsa contribution amount. the family contribution limit is now $6,850. the family contribution limit is now $6,850. it was. Revenue procedure 2018 27 modifies guidance issued by the irs earlier this year (revenue procedure 2018 18), in response to december 2017 tax reform legislation, under which the irs had reduced the hsa contribution limit for individuals with family hdhp coverage from $6,900 to $6,850 for 2018 (tax cuts and jobs act, pub. l. no. 115 97 (2017)). The irs has lowered the dollar limit on deductible contributions to health savings accounts (hsas) for individuals with family coverage under a high deductible health plan. the new limit for 2018 is $6,850, down from the $6,900 limit announced last fall. This is because the tcja made no changes to the section of the internal revenue code that limits benefits and contributions for retirement plans. following is an updated chart for the hsa limits. 2017. 2018. limit on hsa contributions* – single coverage. $3,400. $3,450. limit on hsa contributions* – family coverage. $6,750.

New The Irs Has Lowered The Hsa Family Contribution For 2018 Wex Inc The irs has lowered the dollar limit on deductible contributions to health savings accounts (hsas) for individuals with family coverage under a high deductible health plan. the new limit for 2018 is $6,850, down from the $6,900 limit announced last fall. This is because the tcja made no changes to the section of the internal revenue code that limits benefits and contributions for retirement plans. following is an updated chart for the hsa limits. 2017. 2018. limit on hsa contributions* – single coverage. $3,400. $3,450. limit on hsa contributions* – family coverage. $6,750.

Adjusted 2018 Hsa Limits Announced Family Maximum Lowered From Previou

Comments are closed.