2018 Hsa Contribution Limits Have Changed Again

Hsa 2018 Contribution Limits Adjusted By Irs Medcost Your 2018 hsa contribution limit just changed (again) alicia adamczyk. may 4, 2018 for individuals, the limit is $3,450 for 2018, and the catch up contribution limit for those 55 or older is. Hsa contribution limits. these are the maximum contributions to a health savings account for 2018: $3,450 for individuals (up from $3,000 in 2017). $6,850 for families (up from $6,800 in 2017). if.

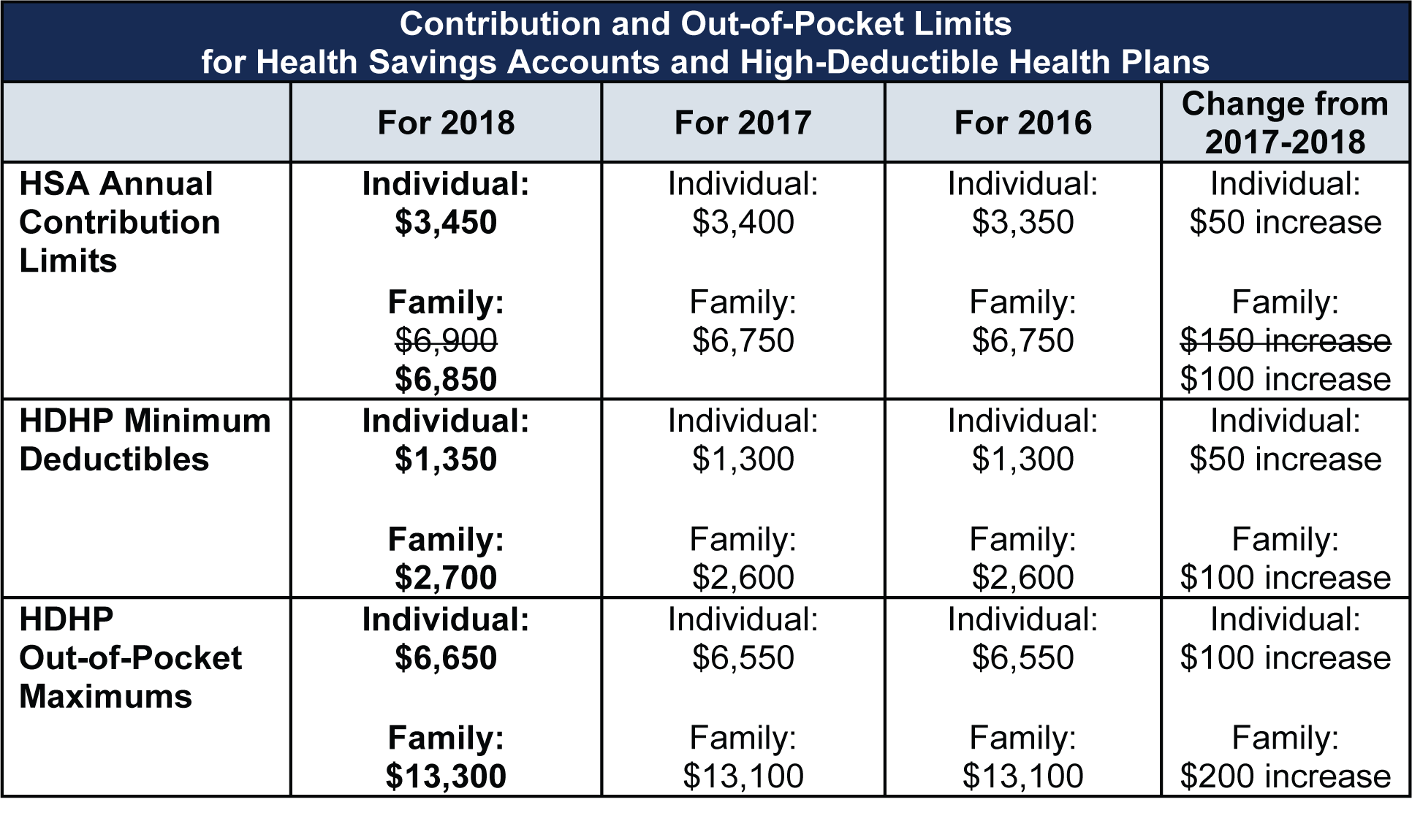

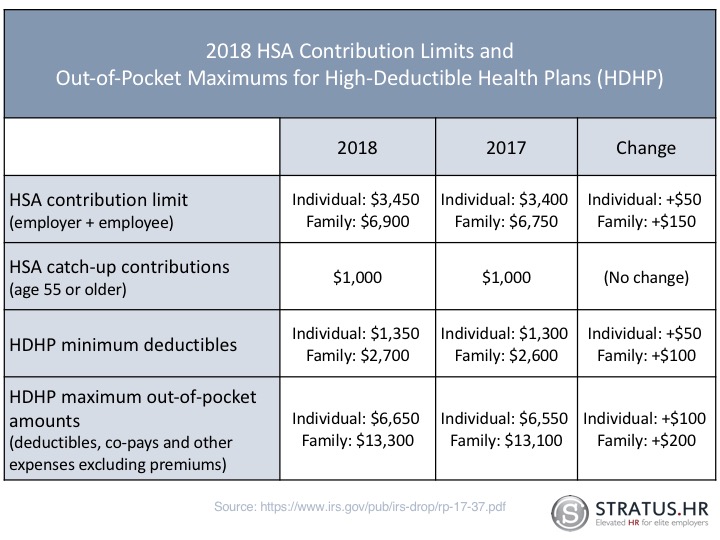

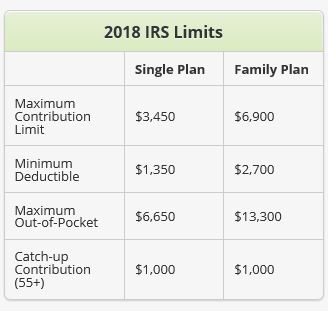

2018 Fsa And Hsa Contribution Limits The maximum contribution families can make to health savings accounts for 2018 is $6,900, after the irs reversed its march decision to lower the limit by $50. The irs has announced it is modifying the annual limitation on deductions for contributions to a health savings account (“hsa”) allowed for taxpayers with family coverage under a high deductible health plan (“hdhp”) for the 2018 calendar year. under rev. proc. 2018 27, taxpayers will be allowed to treat $6,900 as the annual limitation, rather than the $6,850 limitation announced in rev. Employees who changed their hsa elections to comply with the reduced limit may wish to change their elections again for the $6,900 limit. on march 5, 2018, the irs released revenue procedure 2018 18 to announce changes to certain tax limits for 2018, including a reduced contribution limit for health savings accounts (hsas). On march 5th, the irs released rev. proc. 2018 18, addressing a variety of changes to tax rates and inflation adjusted thresholds in accordance with the tax cuts and jobs act passed late in 2017. under the new tax legislation, the methodology for determining adjustments to limits, for things such as fsa and hsa contributions, is tied to a chained cpi, probably resulting in slower upward.

2018 Health Savings Account Contribution Limit Change Employees who changed their hsa elections to comply with the reduced limit may wish to change their elections again for the $6,900 limit. on march 5, 2018, the irs released revenue procedure 2018 18 to announce changes to certain tax limits for 2018, including a reduced contribution limit for health savings accounts (hsas). On march 5th, the irs released rev. proc. 2018 18, addressing a variety of changes to tax rates and inflation adjusted thresholds in accordance with the tax cuts and jobs act passed late in 2017. under the new tax legislation, the methodology for determining adjustments to limits, for things such as fsa and hsa contributions, is tied to a chained cpi, probably resulting in slower upward. 2018 hsa annual contribution limits. self only (single) hdhp coverage = $3,450 ($3,400 in 2017) other than self only (family) hdhp coverage = $6,850 ($6,750 in 2017), previously set at $6,900 for 2018. *special rule for spouses—if one spouse has family coverage, both spouses are treated as having family coverage, but together they cannot. The 2018 annual hsa contribution limit for individuals with self only hdhp coverage will be $3,450 (a $50 increase from 2017), and the 2018 limit for individuals with family hdhp coverage will be $6,900 (a $150 increase from 2017).

Irs Announces 2018 Hsa Contribution Limits Corporate Benefits Network 2018 hsa annual contribution limits. self only (single) hdhp coverage = $3,450 ($3,400 in 2017) other than self only (family) hdhp coverage = $6,850 ($6,750 in 2017), previously set at $6,900 for 2018. *special rule for spouses—if one spouse has family coverage, both spouses are treated as having family coverage, but together they cannot. The 2018 annual hsa contribution limit for individuals with self only hdhp coverage will be $3,450 (a $50 increase from 2017), and the 2018 limit for individuals with family hdhp coverage will be $6,900 (a $150 increase from 2017).

2018 Irs Hsa Contribution Limits Hsa Edge

Comments are closed.