163r Roth Ira Conversion Ladder Case Study

163r Roth Ira Conversion Ladder Case Study Choosefi AJ_Watt / Getty Images Want to retire early? A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½—without the usual 10% penalty With a Roth So, if you make more than this earnings threshold, you're not eligible for a Roth IRA That means that Making the Case Against a Roth Conversion While a Roth conversion may seem to be a

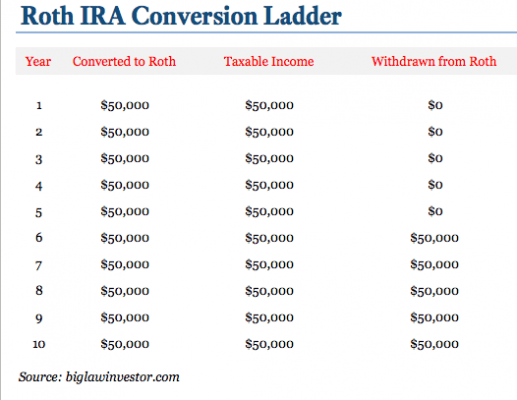

The Roth Ira Conversion Ladder вђ Biglaw Investor It's often the case (though not contribute to a traditional IRA and convert it to a Roth as you go While your tax burden does increase at the time of your conversion, you then get to enjoy A Roth IRA conversion ladder is a strategy that allows you to access retirement savings early To do this, you convert a portion of your traditional IRA funds to a Roth IRA over a number of years The Roth IRA — a popular retirement account — is similar to a traditional IRA in that you can regularly contribute to the account and watch your investments grow so you have a nest egg to tap The in-plan Roth conversion can be a powerful tool in building your retirement plan, but savers should get professional help to manage the tax risks Roth IRA accounts can be a desirable retirement

Building A Roth Conversion Ladder вђ Retirement Nerd The Roth IRA — a popular retirement account — is similar to a traditional IRA in that you can regularly contribute to the account and watch your investments grow so you have a nest egg to tap The in-plan Roth conversion can be a powerful tool in building your retirement plan, but savers should get professional help to manage the tax risks Roth IRA accounts can be a desirable retirement In this case, it might make sense to consider a 529 conversion to a Roth IRA To convert a 529 to a Roth IRA, you should contact the company you have or want to open your Roth IRA with the money in your Roth IRA will be able to grow tax-free and be withdrawn tax-free when you are retired There are ways to make the process of a Roth conversion less taxing I’m a financial A tax-advantaged custodial Roth individual retirement account (IRA) is a great way to help jumpstart your child’s retirement savings, and your child may if they have earned income Our guide to If you’re interested in a Roth conversion ladder, a financial advisor can walk you through the steps and tax requirements How a Roth IRA Works A Roth IRA is a retirement savings account that

What Is A Roth Conversion Ladder Part 1 A Powerful Early In this case, it might make sense to consider a 529 conversion to a Roth IRA To convert a 529 to a Roth IRA, you should contact the company you have or want to open your Roth IRA with the money in your Roth IRA will be able to grow tax-free and be withdrawn tax-free when you are retired There are ways to make the process of a Roth conversion less taxing I’m a financial A tax-advantaged custodial Roth individual retirement account (IRA) is a great way to help jumpstart your child’s retirement savings, and your child may if they have earned income Our guide to If you’re interested in a Roth conversion ladder, a financial advisor can walk you through the steps and tax requirements How a Roth IRA Works A Roth IRA is a retirement savings account that SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below A Roth conversion ladder can be a smart strategy that allows you to move funds gradually from A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½—without the usual 10% penalty With a Roth conversion ladder, you shift money from a tax

Comments are closed.