16 Corporate Venture Capital Investors That Invest In Consumer

16 Corporate Venture Capital Investors That Invest In Consumer Finding the right corporate venture capital that invests in consumer can be hard. here are 16 investors that meet both of those criteria. pitch your company to these investors. Matrix partners china. year founded: 2008. aum: $7.3b. b2c investments: 268. headquartered in beijing, matrix partners china is firm focused on early stage and early growth investments. their main specialization is emerging technologies in fields such as internet, saas, mobile, healthcare, and financial services.

The Top 20 Corporate Venture Capital Firms 3. sosv. sosv is a venture capital firm investing across multiple stages and offering startup development programs as well. sosv has $1.5 billion in assets under management and prioritizes consumer, ecommerce, deeptech, health and wellness, and biotech startups for investment. General catalyst is one of the most prominent venture capital firms in boston. they primarily invest in startups looking for seed funding, but they also work with early stage and later stage companies. as far as seed funding is concerned, they offer an investment of anywhere between $500,000 and $2 million. 32) matrix partners china. matrix partners china is a chinese venture capital investing in early stage and early growth startups in deep technology, industrial innovation, healthcare, frontier technology and consumer brands. details of the vc firm: country: china. city: shanghai, beijing. started in: 1977. The 2024 midas list features 13 women investors, matching 2021’s record number. they include no. 99 annabelle yu long, a china based newcomer at bai capital, and no. 86 annie lamont, connecticut.

The Most Active Corporate Venture Capital Investors Online Marketing 32) matrix partners china. matrix partners china is a chinese venture capital investing in early stage and early growth startups in deep technology, industrial innovation, healthcare, frontier technology and consumer brands. details of the vc firm: country: china. city: shanghai, beijing. started in: 1977. The 2024 midas list features 13 women investors, matching 2021’s record number. they include no. 99 annabelle yu long, a china based newcomer at bai capital, and no. 86 annie lamont, connecticut. General catalyst is a venture capital firm based in cambridge. they invest in early stage and growth companies across industries such as finance, health tech, and software, with check sizes from $500,000 to $2,000,000. their portfolio includes notable companies like monzo and travel perk. general catalyst supports businesses from pre seed to. 2021. in a world where funds keep getting bigger, maveron acts like a maverick and raises a $225m fund 8, to focus on the next generation of ubiquitous consumer brands. maveron is a consumer only venture capital firm focused on partnering with world class entrepreneurs that change the way we live.

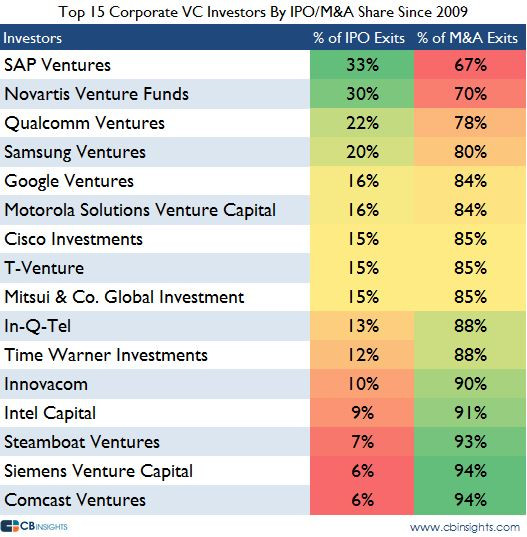

For More Corporate Venture Capital Financing And Exit Data And General catalyst is a venture capital firm based in cambridge. they invest in early stage and growth companies across industries such as finance, health tech, and software, with check sizes from $500,000 to $2,000,000. their portfolio includes notable companies like monzo and travel perk. general catalyst supports businesses from pre seed to. 2021. in a world where funds keep getting bigger, maveron acts like a maverick and raises a $225m fund 8, to focus on the next generation of ubiquitous consumer brands. maveron is a consumer only venture capital firm focused on partnering with world class entrepreneurs that change the way we live.

Comments are closed.