15 Usc Dispute Letter

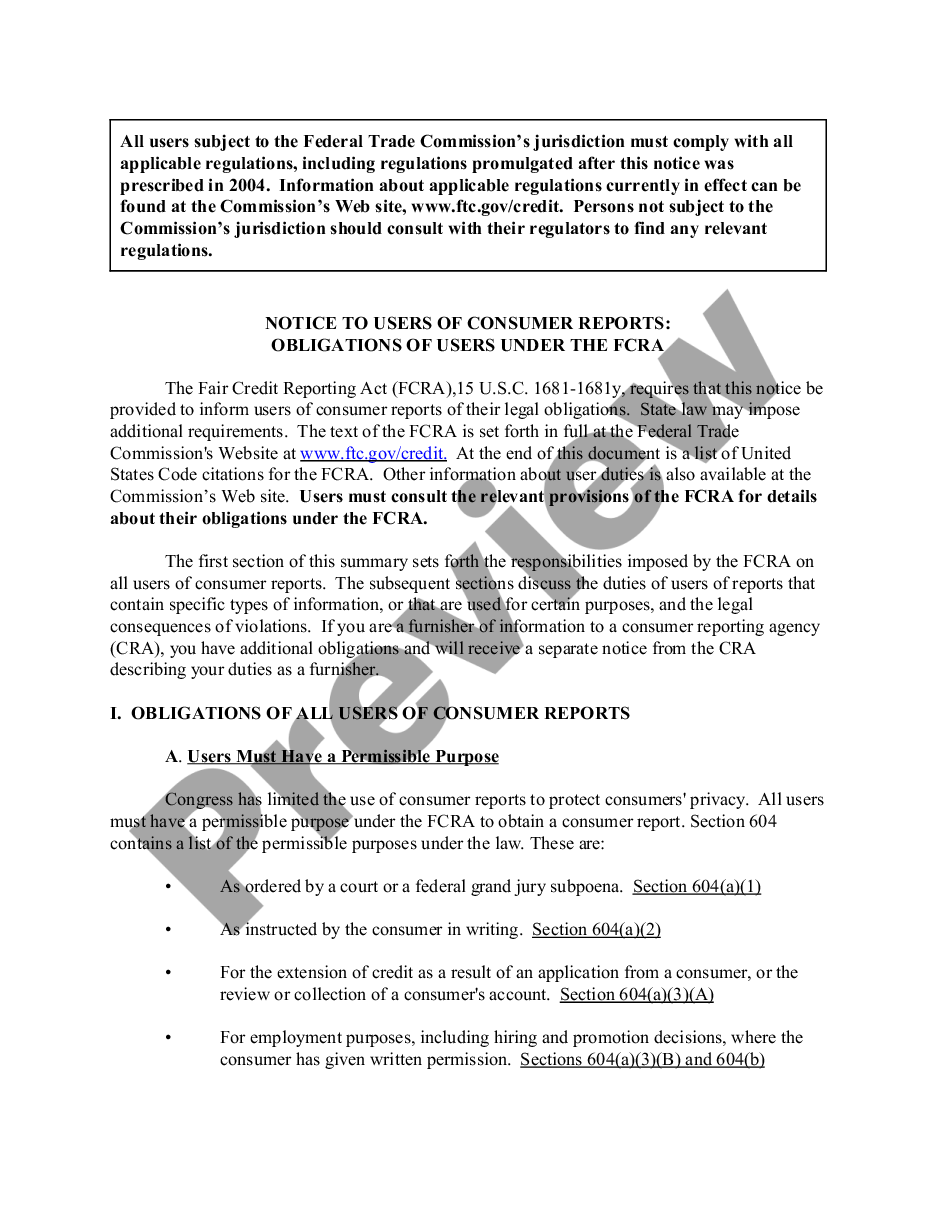

Notice To Users Of Consumer Reports 15 U S C 1681 Letter Us Legal Forms To whom it may concern, please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. §1692g(b). i also request verification, validation, and the name and address of the original creditor pursuant to 15 u.s. c. §1692g(b). sincerely, your name. While the credit dispute letter is an effective method for disputing errors, you can initiate a claim by requesting a validation of debt. 15 u.s.c § 1692g(b) states a debtor can inquire about the origin of a debt by writing and submitting a debt validation letter to the original creditor.

Dispute Letter How To Write With Sample Dispute Letter Doc Template This is a sample dispute letter to a credit bureau to dispute inaccurate information in a credit report. the letter is sent pursuant to the fair credit reporting act found in title 15 section 1681 et seq. of the united states code. the sample is 3 pages and includes brief instructions as well as the current addresses as of november 13, 2014 for. These requests are being made pursuant to the fair credit billing act’s amendments to the truth in lending act, 15 u.s.c. §§ 1666 1666b, 12 c.f.r. § 226.13. see also 12 c.f.r. § 226.12(b). i have enclosed copies of [list the documents you have as evidence of the fraud] as evidence that these charges are fraudulent. Dispute an item on a credit report. step 1 – get a free credit report. step 2 – identify the questionable debts. step 3 – gather internal records. step 4 – creating the dispute. step 5 – sending the dispute. equifax. experian. transunion. 15 u.s. code § 1692g validation of debts. a statement that, upon the consumer ’s written request within the thirty day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor. if the consumer notifies the debt collector in writing within the thirty day.

Dispute Dispute an item on a credit report. step 1 – get a free credit report. step 2 – identify the questionable debts. step 3 – gather internal records. step 4 – creating the dispute. step 5 – sending the dispute. equifax. experian. transunion. 15 u.s. code § 1692g validation of debts. a statement that, upon the consumer ’s written request within the thirty day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor. if the consumer notifies the debt collector in writing within the thirty day. Subject to subsection (f) and except as provided in subsection (g), if the completeness or accuracy of any item of information contained in a consumer’s file at a consumer reporting agency is disputed by the consumer and the consumer notifies the agency directly, or indirectly through a reseller, of such dispute, the agency shall, free of charge, conduct a reasonable reinvestigation to. Upon receiving a dispute from you, they must conduct an investigation, review all relevant information you provide to them with the dispute, and then report the results. they have a duty to correct “incomplete or inaccurate” information. when reporting a delinquency, collection, or charge off, they must report it in a timely manner, which.

Calamг O Use For Your Protection 15 Usc 1692 C Communication Debt Subject to subsection (f) and except as provided in subsection (g), if the completeness or accuracy of any item of information contained in a consumer’s file at a consumer reporting agency is disputed by the consumer and the consumer notifies the agency directly, or indirectly through a reseller, of such dispute, the agency shall, free of charge, conduct a reasonable reinvestigation to. Upon receiving a dispute from you, they must conduct an investigation, review all relevant information you provide to them with the dispute, and then report the results. they have a duty to correct “incomplete or inaccurate” information. when reporting a delinquency, collection, or charge off, they must report it in a timely manner, which.

Comments are closed.