13 Different Types Of Investments How They Work Life Benefits

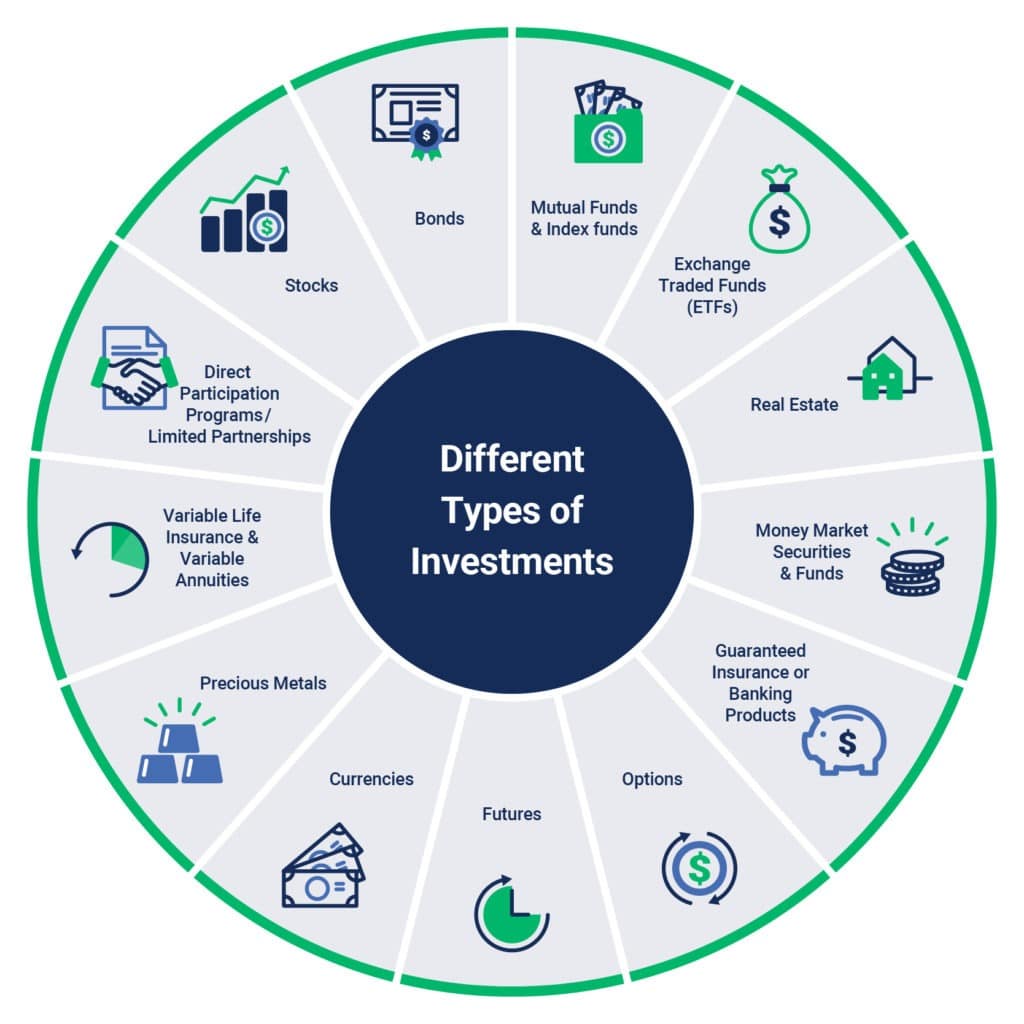

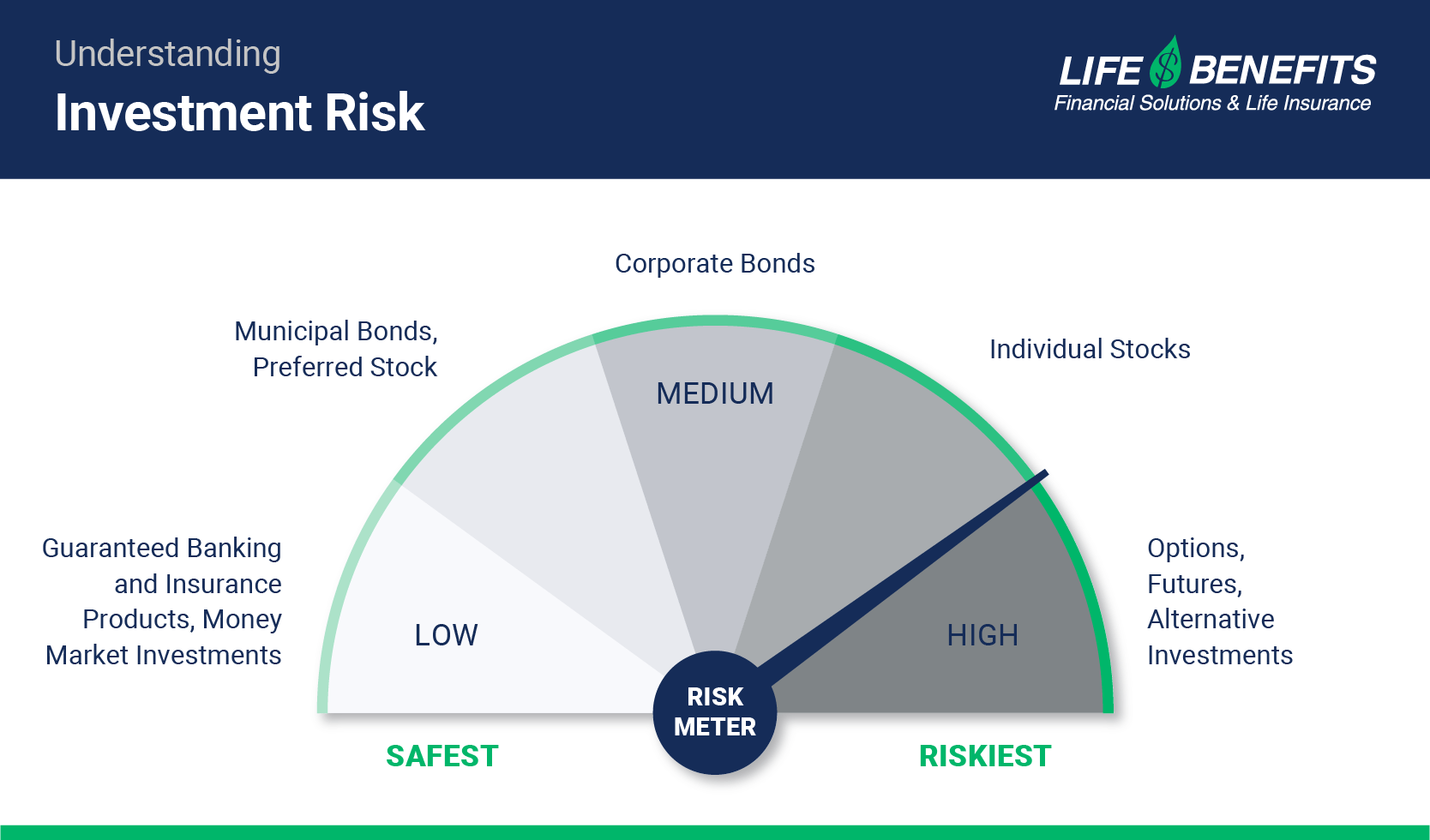

13 Different Types Of Investments How They Work Life Benefits Apr 8, 2024. author john t. mcfie. editorial standards. most investments fit into one of four basic classes: ownership. lending. cash. intangible. when you invest in stocks, you’re buying a piece of ownership in a company, whereas bonds directly involve lending money. 1. stocks. stocks, also known as shares or equities, might be the most well known and simple type of investment. when you buy stock, you’re buying an ownership stake in a publicly traded company. many of the biggest companies in the country are publicly traded, meaning you can buy stock in them.

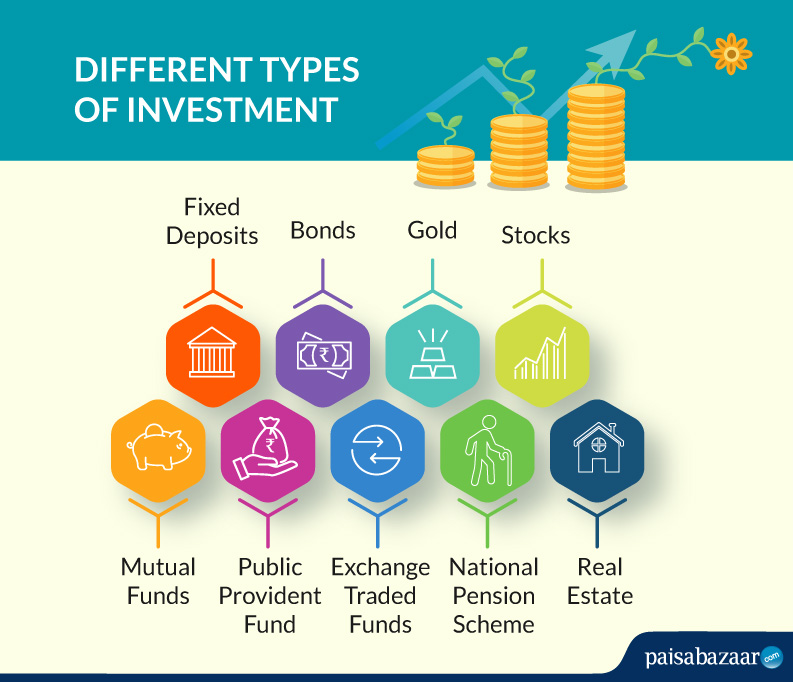

Know What Are The Different Types Of Investment Paisabazaar Here’s a closer look at 13 specific types of investments to consider in 2024. 1. alternative assets. my definition of alternative assets is anything that isn’t stocks, bonds, or commodities, but many people use slightly different definitions. here’s a list of all the best alternative investments. Exchange traded funds (etfs) an etf is a collection of securities (stocks, bonds, commodities, funds) that is traded in a single transaction, similar to a mutual fund. however, unlike mutual funds, they’re traded throughout the day on an exchange, like a stock. (a mutual fund can only be traded once per day at the end of the trading day.). Having different types of investments, as well as short term vs long term investments can help you achieve portfolio diversification. 1. stocks. when you think of investing and investment types, you probably think of the stock market. they are, essentially, investment fund basics. a stock gives an investor fractional ownership of a public. Stocks, bonds and cash are all asset classes. investopedia breaks up all the different types of investments into these basic categories: investments you own, lending investments and cash.

The 13 Types Of Investment A Guide For Beginners вђў The Fashionable Having different types of investments, as well as short term vs long term investments can help you achieve portfolio diversification. 1. stocks. when you think of investing and investment types, you probably think of the stock market. they are, essentially, investment fund basics. a stock gives an investor fractional ownership of a public. Stocks, bonds and cash are all asset classes. investopedia breaks up all the different types of investments into these basic categories: investments you own, lending investments and cash. Bonds. esg. stocks. cash investments. cryptocurrency. investment type comparisons. explore how much cash you should maintain in your portfolio. learn the benefits and risks of cash holdings and how they can provide liquidity and stability in your investments. learn about different types of esg funds to give you a feel for how they’re. High grade bonds issued by major, reliable businesses, are safer investments because you can better count on them to repay the loan. lower grade bonds issued by smaller businesses with less established track records are riskier, because these business are less able to guarantee repayment. 4. stocks.

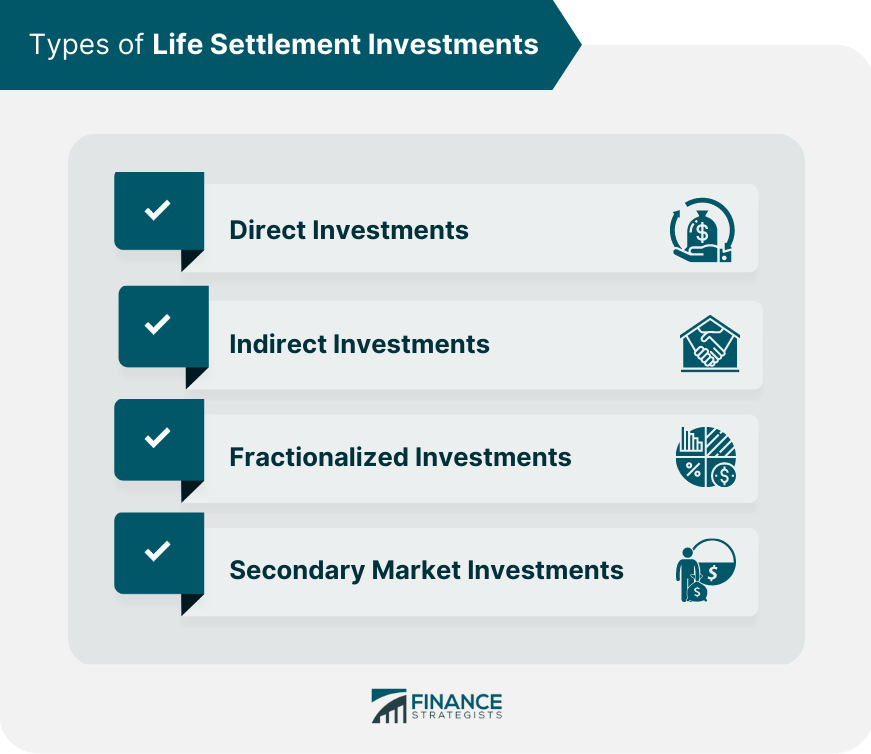

Life Settlement Investments Definition Benefits Risks Types Bonds. esg. stocks. cash investments. cryptocurrency. investment type comparisons. explore how much cash you should maintain in your portfolio. learn the benefits and risks of cash holdings and how they can provide liquidity and stability in your investments. learn about different types of esg funds to give you a feel for how they’re. High grade bonds issued by major, reliable businesses, are safer investments because you can better count on them to repay the loan. lower grade bonds issued by smaller businesses with less established track records are riskier, because these business are less able to guarantee repayment. 4. stocks.

13 Different Types Of Investments How They Work Life Benefits

Comments are closed.