11 Steps To Buying A Home

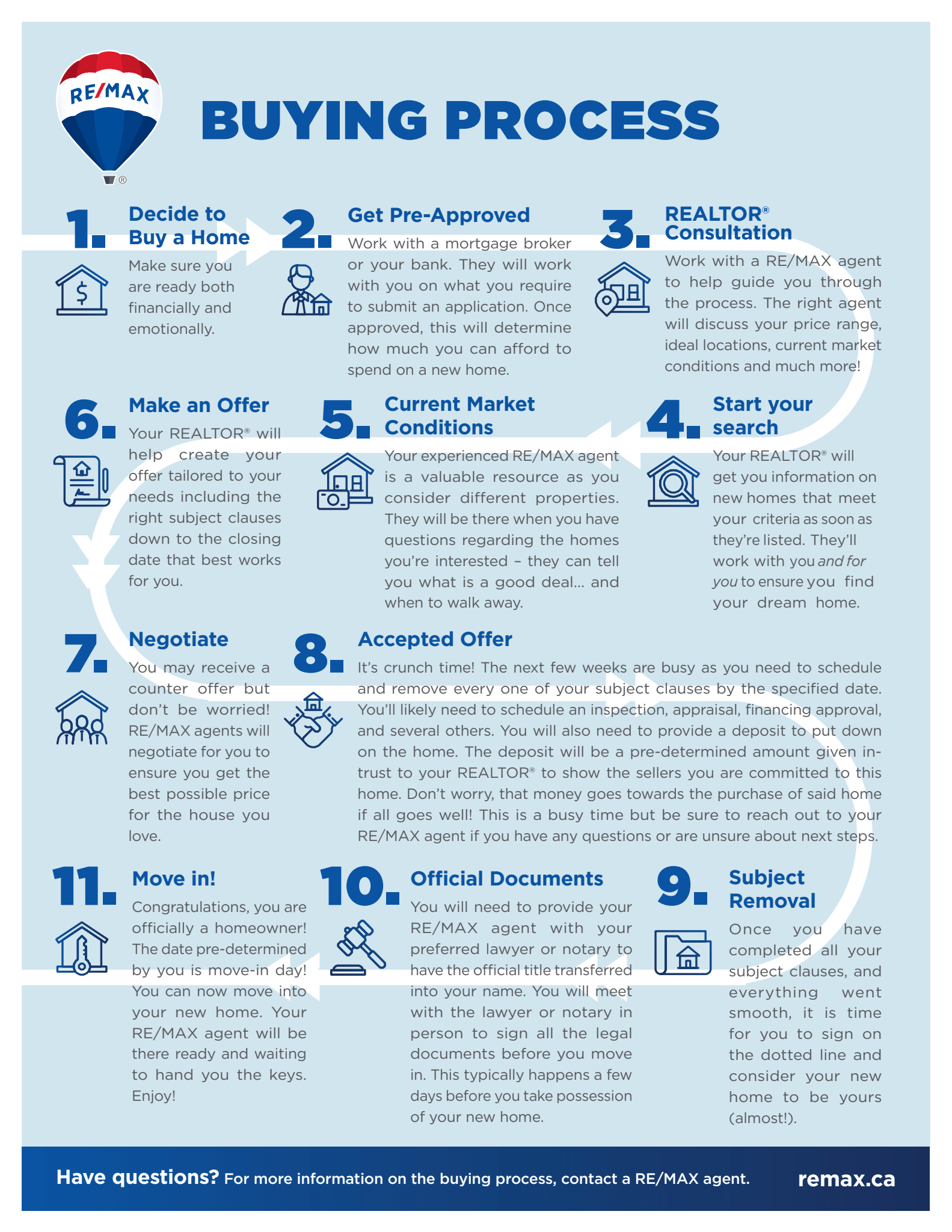

11 Steps To Buying A Home Rebates and funding for renovations, home maintenance calendars and emergency planning. download the pdf guide and workbook for complete information and customized calculators. save your workbook regularly to track your budget, calculations and notes. homebuying guide workbook and checklists. next decide if homeownership is right for you. We’ve put together a step by step guide to buying a home, to help you get off on the right foot when it comes to buying a home. click the download button below to download these steps in pdf form. if you’re ready to begin the buying process, click here to find an agent! download the infographic. canadian real estate news published weekly.

The 11 Steps To Buying A Home Ppt So many details to consider! to help you better prepare for this unique adventure, we have created a comprehensive twelve step guide to buying a home. 1. identify your needs before buying a property. determining your needs before buying a property is the first step in any home buying project. location. Here’s our 10 step home buying process checklist to get you started! 1. choose a real estate agent that’s right for you. a home is a huge investment, so work with a realtor that’s knowledgeable, professional and responsive. treat your search for the right agent like a job interview. Use the upfront purchase costs worksheet in step 2 of the workbook. the home buyers’ plan allows first time homebuyers to contribute to their down payment by withdrawing funds, tax free, from their registered retirement savings plan (rrsp). the funds are then paid back in instalments over up to 15 years. The home buyers’ plan. the home buyer’s plan allows you to withdraw up to $60,000 from your registered retirement savings plan ($120,000 per couple) to make a down payment on your first home.

Steps To Buying A Home In 2018 2019 Use the upfront purchase costs worksheet in step 2 of the workbook. the home buyers’ plan allows first time homebuyers to contribute to their down payment by withdrawing funds, tax free, from their registered retirement savings plan (rrsp). the funds are then paid back in instalments over up to 15 years. The home buyers’ plan. the home buyer’s plan allows you to withdraw up to $60,000 from your registered retirement savings plan ($120,000 per couple) to make a down payment on your first home. Determine your budget. determining your budget is a crucial first step toward buying a home in canada as a first time homebuyer. understanding your financial situation and calculating your affordability will help you determine how much house you can afford, saving you time and effort in home buying. take stock of your income, expenses, and debt. Rrsp home buyer’s plan. allows first time homebuyers to withdraw up to $35,000 from their rrsp (or $70,000 for a couple) to finance a down payment. the rrsps must be at least 90 days old, and.

Comments are closed.