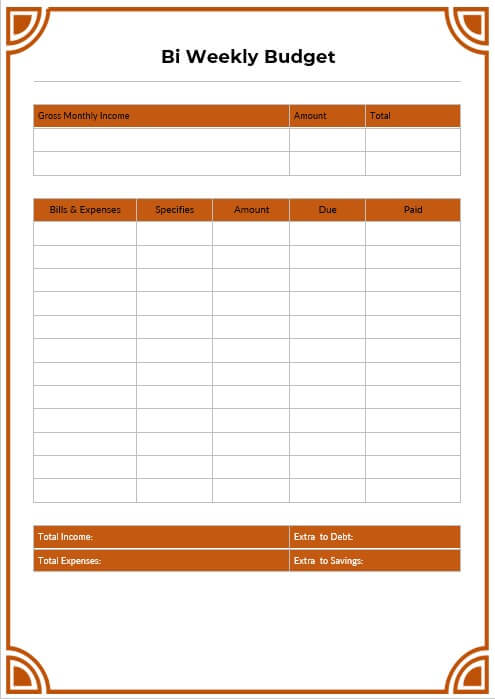

10 Bi Weekly Budget Template Room Surf

10 Bi Weekly Budget Template Room Surf What is bi weekly budget template. this budget template is one to manage finance every two weeks of the month. sure, there is monthly budget to make as well, but bi weekly budget format makes it easier for you to make change and update when necessary. after all, there could be emerging issues, such as extra income or unexpected cost too. Setting up a bi weekly budget can be done with the following 5 steps. first of all, you will have to list your bills completely and accurately. second of all, what you will need to do is to fill a bill payment calendar. third of all, you should write your 1 st bi weekly budget. after that, you can continue with your 2 nd bi weekly budget.

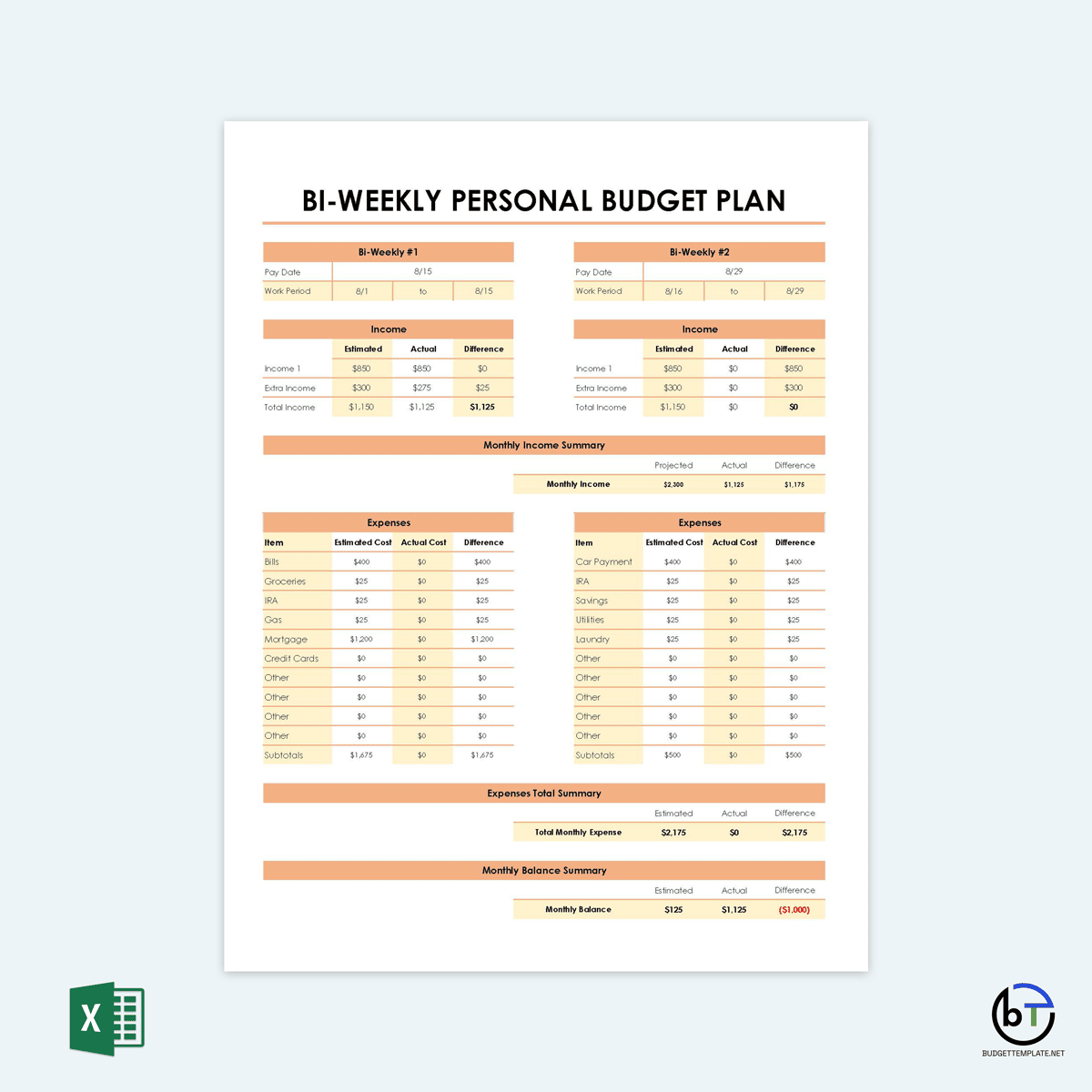

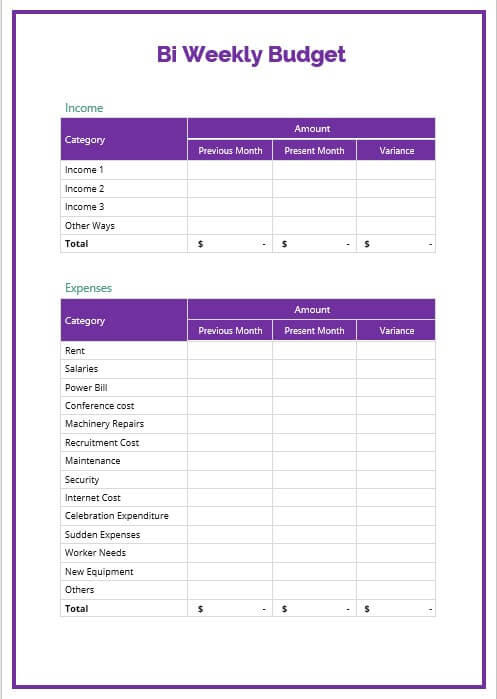

Free Bi Weekly Budget Planners And Templates Excel 5. decide on your savings, investing, & financial goals. setting financial goals is crucial for a productive biweekly budget. i like realistic and specific goals, writing them down and visualizing them on a vision board. some goals to consider: save for retirement. pay off credit card debt. build an emergency fund. Keep details like when you spent it, where you made the purchase and how much you spent. #6 make a routine schedule keeping a budget schedule is necessary. this helps you keep tabs on your spending and see how much extra you have leftover. since you are on a bi weekly budget, you should have a budget routine where the day before every paycheck. 5 bi weekly budget template. budgets come in varied shapes and sizes. one such is the bi weekly budget. as its designation implies, this is a budget that is crafted twice a week. it hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. Yes, a bi weekly budget and a semi monthly budget are different. with a bi weekly budget, you are planning your finances based on getting paid every 2 weeks (14 days). in a 12 month period would get paid 26 times. whereas with a semi monthly budget, your plans will be based on getting paid twice a month. and in a twelve month period, you’ll.

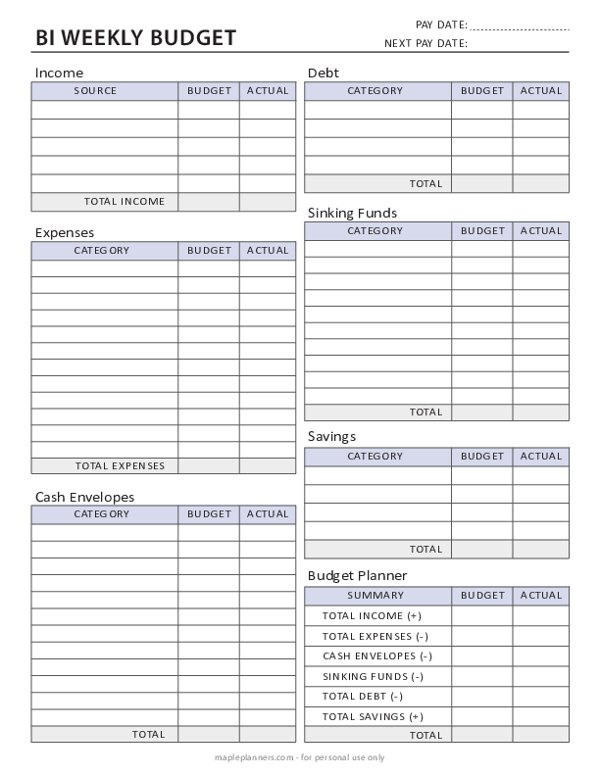

Printable Bi Weekly Budget Template Francesco Printab Vrogue Co 5 bi weekly budget template. budgets come in varied shapes and sizes. one such is the bi weekly budget. as its designation implies, this is a budget that is crafted twice a week. it hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. Yes, a bi weekly budget and a semi monthly budget are different. with a bi weekly budget, you are planning your finances based on getting paid every 2 weeks (14 days). in a 12 month period would get paid 26 times. whereas with a semi monthly budget, your plans will be based on getting paid twice a month. and in a twelve month period, you’ll. Step 1: print a calendar. to effectively track your paychecks and expenses, you need a calendar. a budget calendar is an excellent way to mark your paydays and the due dates for bills. moreover, you can also mark special occasions, such as birthdays or vacations, to include those expenses as well. Step 1: create your budget categories. the first step is to create the expense categories for your monthly budget. your expenses should normally fall into two categories: mandatory and discretionary. mandatory expenses: mandatory expenses must be paid monthly and include items such as rent, groceries, and utilities.

Weekly Budget Biweekly Budgetbudget Templatebudget By Etsy Australia Step 1: print a calendar. to effectively track your paychecks and expenses, you need a calendar. a budget calendar is an excellent way to mark your paydays and the due dates for bills. moreover, you can also mark special occasions, such as birthdays or vacations, to include those expenses as well. Step 1: create your budget categories. the first step is to create the expense categories for your monthly budget. your expenses should normally fall into two categories: mandatory and discretionary. mandatory expenses: mandatory expenses must be paid monthly and include items such as rent, groceries, and utilities.

10 Bi Weekly Budget Template Room Surf

Comments are closed.